- Q1 Results: KEC International Reports Strong Profit Growth and Plans ₹6,000 Crore Fundraising Initiative

- Stock Market Wrap July 26, 2024: Sensex Jumps 1,293 Points; Nifty Hits Record High of 24,839

- IPO Alert: Suraksha Diagnostic files draft papers with SEBI

- ITC to Invest ₹20,000 Crore Over Medium Term, Says CMD Sanjiv Puri

- VVIP Infratech IPO Allotment to be Finalised Today; How to Check Status

TOP NEWS

Q1 Results: KEC International Reports Strong Profit Growth and Plans ₹6,000 Crore Fundraising Initiative

Stock Market Wrap July 26, 2024: Sensex Jumps 1,293 Points; Nifty Hits Record High of 24,839

IPO Alert: Suraksha Diagnostic files draft papers with SEBI

ITC to Invest ₹20,000 Crore Over Medium Term, Says CMD Sanjiv Puri

VVIP Infratech IPO Allotment to be Finalised Today; How to Check Status

Rupee Analysis: INR Rises Ahead Of US June PCE Data

Tech Mahindra Q1 Results: Net Profit Jumps 23% to Rs 851 Crore,

Currency Market Update July 26, 2024: USDINR, EURINR, GBPINR, JPYINR Highlights

Stock Market Wrap July 15, 2023: Sensex, Nifty End Flat on Expiry Day, Gains in Auto, Oil & Gas, Media Sectors

Pound Slides Against Dollar as Market Awaits US GDP Figures

Nestle India Q1 Results: Net Profit Rises 7% to ₹746.6 Crore, Revenue Up 3.3% YoY

Oil Prices Decline Amid China Demand Worries and Middle East Ceasefire Hopes

Sanstar IPO Allotment Finalised: Latest GMP and How to Check Your Status

Currency Market Update July 25, 2024: USDINR, EURINR, GBPINR, JPYINR Highlights

Stock Market Wrap July 24, 2024: Sensex and Nifty 50 Decline for Fourth Straight Session

V L Infraprojects IPO Oversubscribed by 119.51x on Day 2: Key Details

Japanese Yen Analysis July 24, 2024

Torrent Pharmaceuticals Q1 Results: Profit Rises by 20.9% YoY

Rupee Analysis: INR Down Despite Stronger India’s PMI Data

Kataria Industries Shares Make Stellar Debut with 90% Premium on NSE SME

OVERVIEW

DEFINITION

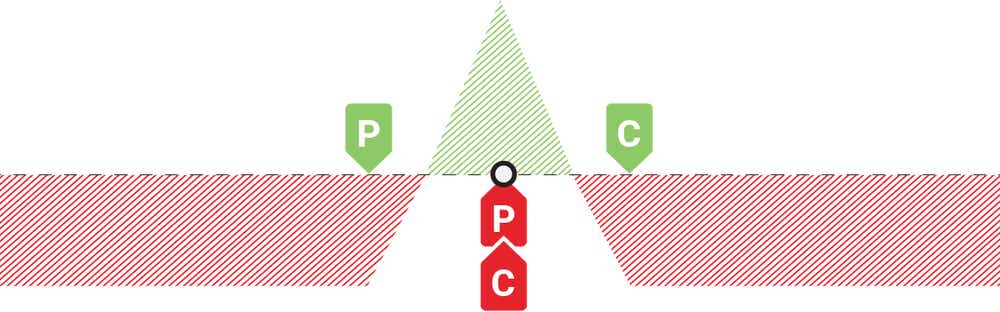

An iron fly is essentially an iron condor with call and put credit spreads that share the same short strike. This creates a very neutral position that profits from the passage of time and any decreases in implied volatility. An iron fly is synthetically the same as a long butterfly spread using the same strikes.

DIRECTIONAL ASSUMPTION

Neutral

IDEAL IMPLIED VOLATILITY ENVIRONMENT

High

PROFIT/LOSS CHART

SETUP

Buy OTM Put Option

Sell Straddle

Buy OTM Call Option

HOW TO CALCULATE MAX PROFIT / BREAKEVEN(S)

MAX PROFIT

Credit Received

BREAKEVEN(S)

Upside:

Short Call Strike + Credit Received

Downside:

Short Put Strike – Credit Received

CurrencyVeda APPROACH

An iron fly is a defined-risk, at-the-money straddle. Due to the long call and put options, the iron fly requires much less buying power than a straddle. At tastylive, we generally use this strategy when we have a neutral assumption in a high implied volatility (IV) stock. Short iron fly profits are realized when volatility contracts and we are able to purchase the spread to close for less than the initial credit received.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content

Accordion Content