Gold is having trouble keeping its gains above $2,000 after falling to $1,981.66 on Monday. The FX board is all about the weakening of the US dollar as a whole. This is because the stock market is doing better and US inflation numbers are coming up.

Technical Overview

The daily chart for the XAU/USD pair shows that the recent drop was just a correction and that Gold is ready to keep going up. The pair stays well above bullish moving averages. The 20 Simple Moving Average (SMA) provides dynamic support at around $1,973.15. At the same time, the Momentum indicator jumped sharply from around its midline, and its strongly bullish slope stayed the same. The Relative Strength Index (RSI) also went up, and it is now near 62.

The 4-hour chart shows that XAU/USD is neutral in the short term. The pair is above its 100 and 200 SMAs, which are both bullish, but it is struggling to get past its 20 SMA, which is slightly bearish. At the same time, technical indicators don’t have much strength in one direction or the other and are stuck in the middle. If the pair goes above $2,011.70, which is an immediate static resistance level, bulls may have a better chance.

Support levels: 1,998.20 1,987.40 1,973.15

Resistance levels: 2,011.70 2,024.90 2,035.60

Fundamental Overview

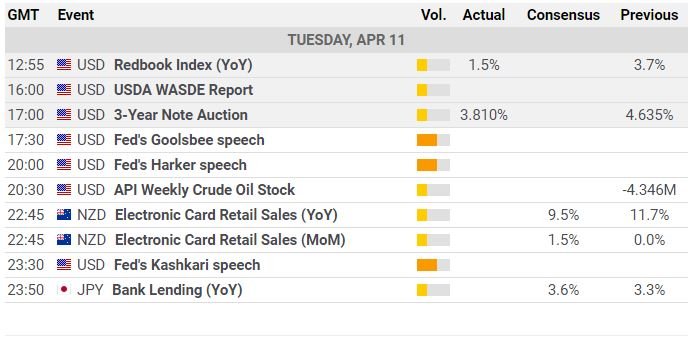

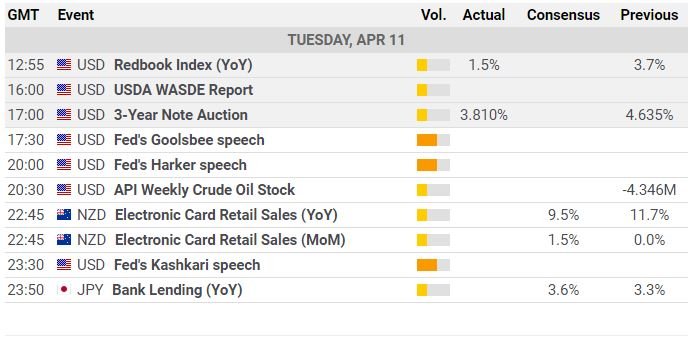

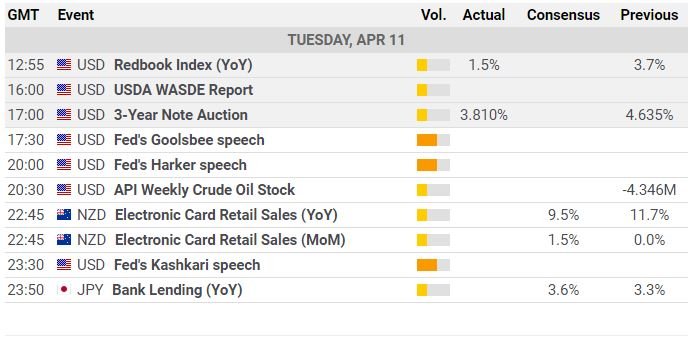

Gold is having trouble keeping its gains above $2,000 after falling to $1,981.66 on Monday. The FX board is all about the weakening of the US dollar as a whole. This is because the stock market is doing better and US inflation numbers are coming up. As most global indexes trade in the green, XAU/USD is close to its daily high of $2,007.44. In the United States, the Dow Jones Industrial Average is up 146 points and is now trading at its highest level since early January. On the other hand, the Nasdaq Composite is down 0.37%.

People on the market are selling the Greenback before the US March Consumer Price Index (CPI), which is expected to show that core inflation has gone up on an annual basis. A few weeks ago, such a result would have made people think that the Federal Reserve (Fed) might raise interest rates quickly. However, since the US banking crisis in mid-March, this is no longer the case. After two local banks failed, the central bank took a more cautious approach to monetary tightening. This is because draining liquidity to stop inflationary pressures has a lot of bad effects.

At the same time, fears of a recession keep growing. Macroeconomic data that was not good and the unexpected decision by OPEC+ to cut oil production led to a bad mood on the market, which seems to be on hold for now. Still, risk-averse situations don’t help the Greenback much these days. Gold, on the other hand, is making the most of them.

Source: Team CurrencyVeda