February 15, 2023

New Delhi, India

India Surges to Fourth Largest Stock Market, Surpassing Hong Kong

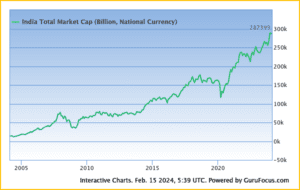

India’s stock market has recently reached the top 4 in terms of valuation, surpassing Hong Kong’s market capitalization and trailing just behind the United States, China, and Japan. This milestone is a result of various factors, including economic growth, regulatory reforms, and increased participation from foreign investors.

Source: Wikipedia

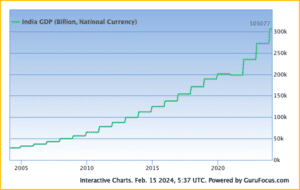

One significant factor is India’s massive population and growing economy. As the world’s fifth-largest economy by GDP, India offers a large consumer base and a vast pool of human resources, attracting both local and foreign investments. The country’s GDP growth rate has been relatively stable, averaging around 6-7% over the past few years, making it an attractive destination for investors.

- Population and Economy:

- India, with its massive population, plays a pivotal role in global economics. It is home to over 1.3 billion people, making it the second-most populous country in the world.

- As the fifth-largest economy by Gross Domestic Product (GDP), India wields significant influence. Its large consumer base and abundant human resources make it an attractive destination for investors.

- The combination of a vast market and a skilled workforce draws both local and foreign investments.

- GDP Growth Rate:

- India’s GDP growth rate has been relatively stable over the past few years. On average, it has hovered around 6-7% annually.

- This consistent growth makes India an appealing choice for investors seeking long-term opportunities.

- Economic Resilience:

- Despite global economic challenges, India has demonstrated resilience and maintained healthy macroeconomic fundamentals.

- The International Monetary Fund (IMF) has revised its growth projection for India in FY2023-24 to 6.3% 1. Additionally, the Asian Development Bank (ADB) projects India’s GDP growth to be 6.4% in FY2023 and 6.7% in FY2024 2.

- The OECD predicts India to grow at 6.1% in 2024, outpacing other major economies like China and Brazil 1.

Data: https://www.gurufocus.com/global-market-valuation.php?country=IND

SEBI

Regulatory reforms play a crucial role in the development of India’s stock market. The Securities and Exchange Board of India (SEBI), formed in 1992, has been instrumental in setting up market rules in line with global best practices. SEBI has consistently tried to improve transparency, protect investor interests, and ensure a fair and orderly market. These efforts have made India’s stock market more accessible, efficient, and reliable for both domestic and international investors.

FDI And FPI

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) have been on the rise in India. The country permits foreign investments in various sectors, with different FDI limits. FPI is allowed up to 10% of the equity of any one company, with a 24% limit on overall investments, which can be increased to 30% with shareholder approval. Such investments have contributed to the growth of India’s stock market valuation, as foreign institutional investors bring in additional liquidity and help develop the capital market.

- Foreign Direct Investment (FDI):

- FDI refers to investments made by foreign entities directly into the economy of another country. These investments are typically long-term and involve acquiring a significant ownership stake in local businesses or assets.

- In India, FDI is permitted across various sectors, subject to specific guidelines and limits. The government has progressively liberalized FDI norms to attract more foreign capital.

- Different sectors have different FDI limits, which determine the maximum percentage of foreign ownership allowed. For instance:

- Automobiles: Up to 100% FDI is allowed in the automobile sector.

- Retail (single-brand): Up to 100% FDI is permitted in single-brand retail.

- Insurance: FDI up to 49% is allowed in the insurance sector.

- Telecom: FDI up to 100% is permitted in telecom services.

- Construction and development projects: Up to 100% FDI is allowed.

- FDI inflows contribute to economic growth, job creation, technology transfer, and infrastructure development.

- Foreign Portfolio Investment (FPI):

- FPI refers to investments made by foreign investors in financial instruments such as stocks, bonds, and other securities. Unlike FDI, FPI is typically short-term and does not involve direct ownership or control of companies.

- India allows FPI through the portfolio investment route. Key points include:

- Equity Investment: FPIs can invest up to 10% of the equity of any one Indian company.

- Overall Investment Limit: The aggregate FPI investment across all companies is capped at 24% of the company’s paid-up capital.

- Shareholder Approval: Companies can raise the overall FPI limit to 30% with shareholder approval.

- FPIs play a crucial role in providing liquidity to the stock market and contribute to its overall valuation.

- They also help develop the capital market by participating in trading, stabilizing prices, and enhancing market efficiency.

Also Read: FPI Investments Surge: Boosting Confidence in India’s Economic Growth

The development of the financial infrastructure and technology sector has also contributed to India’s stock market growth. The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are the two primary stock exchanges in India, providing a platform for trading in equities, derivatives, and debt securities. The adoption of digital technologies and regulatory support has led to increased participation from retail and institutional investors, further boosting market capitalization.

The Sensex and Nifty are two major benchmark indexes in India, consisting of 30 and 50 of the largest listed companies, respectively. These indexes are widely tracked and used as a reference for investment strategies, thereby driving the growth of these companies and contributing to India’s overall stock market valuation.

Data: https://www.gurufocus.com/global-market-valuation.php?country=IND

In summary, India’s ascent to the top echelons of the global stock market can be attributed to several key factors:

- Robust Economy:

- India’s strong economic fundamentals have propelled it forward. A large and growing economy provides a fertile ground for investment opportunities.

- The country’s favorable demographics, with a young and dynamic population, contribute to its economic resilience.

- Regulatory Reforms:

- India has undertaken significant reforms to enhance its business environment. Initiatives like the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) have streamlined processes and improved investor confidence.

- Foreign Investments:

- Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) have surged. Investors recognize India’s potential and are keen to participate in its growth story.

- FPIs, in particular, bring in additional liquidity and contribute to the development of the capital market.

- Financial Infrastructure and Technology:

- The growth of India’s financial infrastructure and the technology sector has been remarkable. Digitalization, fintech innovations, and robust banking systems facilitate seamless transactions.

- Market Transparency and Investor Protection:

- Efforts to maintain transparency in the stock market are crucial. Regulatory bodies ensure fair practices and protect investors’ interests.

- SEBI (Securities and Exchange Board of India) plays a pivotal role in regulating the market and safeguarding investor rights.

- Continued Momentum:

- India’s journey to the top 4 globally is not an endpoint but a milestone. Sustained efforts to foster economic growth, attract investments, and protect stakeholders will be essential.

- As long as India remains committed to these principles, it will continue to be a leading player in the global stock market.

In this dynamic landscape, India’s stock market stands as a beacon of opportunity, drawing investors from around the world.

Check Latest Q3 Earnings

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.