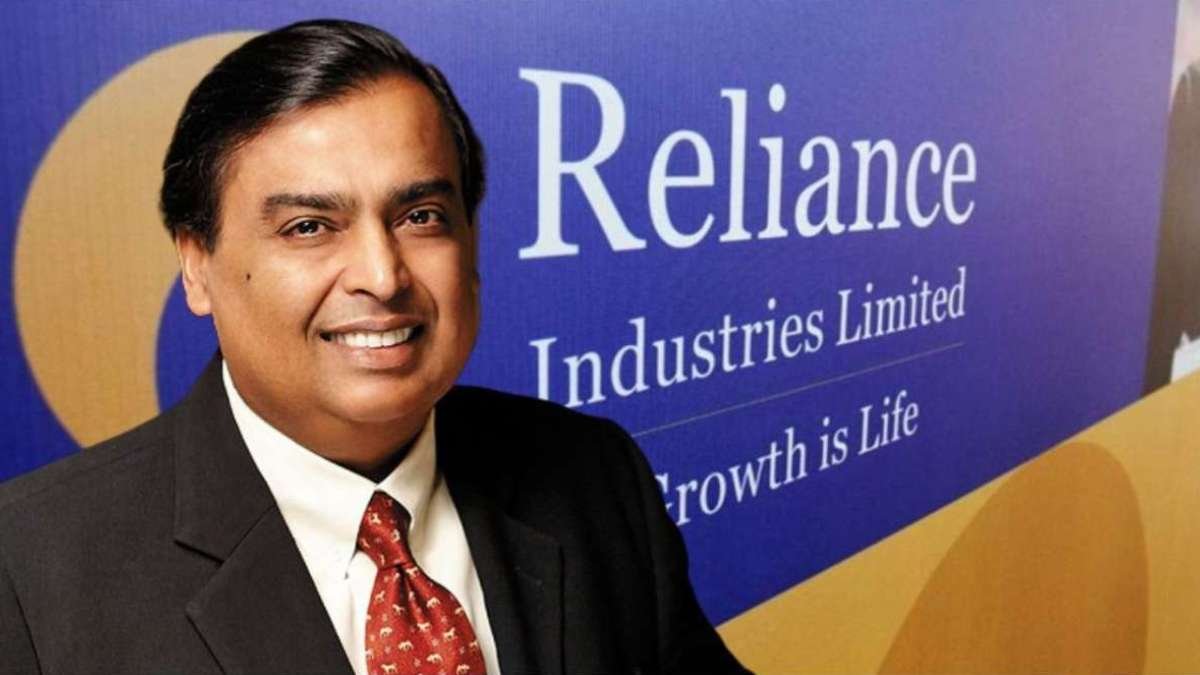

Reliance Industries Ltd. (RIL) is still viewed as a relative outperformer in CY23 by global brokerage JPMorgan, despite the possibility of a generally weakening earnings environment. Nevertheless, various potential catalysts are anticipated to assist drive absolute outperformance in CY24–CY25.

We predict that the refining sector will continue to be strong, that the reopening of China will likely lead to a rebound in Petrochem spreads from decadal low levels, and that E&P volume growth will drive profitability growth. Further investments could propel the following leg of growth as RIL continues to offer many growth options across industries (petrochem, E&P, telecom, retail, financial services, new energy).

RIL’s continued investments and capital expenditures should enable it to expand its (already industry-leading) petrochemical, telecom, and retail businesses. Although we do not see new energy to be material to the investment case for the upcoming 12- to 18-month period, Jio Financial Services is expected to be the main topic of discussion at this year’s RIL annual general meeting (AGM) (JFS). The brokerage has updated its March 2024 target price to $2,960 per share while maintaining its Overweight (OW) rating.

“Instead of reflecting fresh stock-specific risks, the stock’s multiple compression over the past year looks to mimic the index derating. FII holdings are at six-year lows as a result of the FII selldown. Robust cash flows from O2C, E&P enable RIL to continue investing across companies “JPMorgan threw in.

In early trade deals on Thursday, shares of Reliance Industries reached a 52-week low of $2,202 per share on the BSE. In the past year, the stock has decreased by more than 6%.

“Jio’s wireless market leadership is still growing, but the non-telecom sector has taken a while to recover. Retail development, however, has been rapid. Reliance Retail’s emphasis and investments on sq feet additions, omni-channel distribution, multiple brands/acquisition, own brands focus, large warehousing space additions, and scaling up new commerce/Jio Mart/FMCG are positive, even though near-term retail growth should slow down in line with weaker consumer demand “It was ad.

The opinions and suggestions listed above are not Currency Veda’s; rather, they represent the opinions of certain analysts or brokerage firms.