- The financial sector crisis worsened, causing the fall of the S&P 500, Nasdaq 100, and Dow Jones.

- After a stellar January report, the US Producer Price Index cooled while retail sales fell.

- Investors anticipate that the Federal Reserve will maintain the Federal Funds Rate at its upcoming meeting.

As the banking crisis worsened, Wall Street imploded. Credit Suisse’s (CS) stock fell 24% in one day as a result of statements from its top shareholder declining to participate in the bank for “regulatory and statutory concerns.” Because of it, the price of CS stock has fallen, and its Credit Default Swaps (CDS) are at levels last seen during the Global Financial Crisis (GFC).

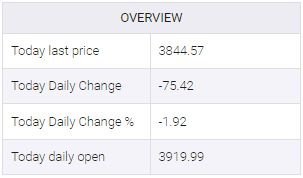

Hence, the S&P 500 is falling 1.46% and is now at 3,862.14. The Dow Jones is down 1.74% at 31,598.13, while the heavy-tech Nasdaq 100 is down 0.76% at 11,342.55.

Notwithstanding the panic sale by Credit Suisse, sentiment is still negative. Almost 80% of the listed S&P 500 equities declined, while all of the Bank’s shares saw losses. In addition, the February Retail Sales and Producer Price Index (PPI) were made public by the US economic calendar. Retail Sales fell by 0.4% instead of the anticipated 0.3% MoM decline, which was partially attributed to the startling 3.2% January figure.

The US Bureau of Labor Statistics stated today that the US Producer Price Index (PPI) fell 0.1% MoM. Core PPI, which does not include erratic categories like food and energy, decreased from forecasts of 0.4% to 0%.

The Federal Reserve (Fed) was expected to raise rates by 25 bps, although those expectations had since diminished. Investors anticipate no change to the Federal Funds rate (FFR) at next week’s meeting, according to the CME FedWatch Tool odds for a 25 bps raise, which are now at 37%.

Utilities and Communications Services are the two leading industries, increasing 1.16% and 0.25%, respectively. Energy and Materials are the laggards, dropping 6.18% and 4.42%, respectively.

The US Dollar Index is up 1.21% at 104.937, indicating that the dollar is rising after three straight days of losses. The yields on US Treasury bonds continued to decline across the curve, with the 2-year falling 43 basis points to 3.823% and the 10-year decreasing 28 basis points to 3.410%.

S&P 500 Daily chart

SP 500

Source: Team CurrencyVeda