February 19, 2023

New Delhi, India

UK And Japan’s Recession

Both Japan and the United Kingdom announced on Thursday that their economies likely experienced a downturn during the last quarter of 2023. This would mark the second consecutive quarter of economic contraction for both nations, which aligns with one common definition of a recession.

A recession is typically defined as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. In layman’s terms, it’s often described as two consecutive quarters of negative GDP growth.

United Kingdom’s Economy: The UK economy fell into recession at the end of 2023, with a contraction of 0.3% in the final quarter. This followed a fall in the previous quarter, marking two successive quarters of contraction, which is typically considered a technical recession. The contraction was more than expected and was due to declines in all three main sectors: services, industrial production, and construction. High interest rates, raised to reduce inflation, have been identified as a significant factor hobbling the economy.

Japan’s Economy: Japan’s economy slipped into recession in the final quarter of 2023, marking the second consecutive quarter of contraction. The country’s Gross Domestic Product (GDP) shrank by 0.1% in the last three months of 2023 due to weak spending by households and businesses1. This contraction led to Japan losing its position as the world’s third-largest economy to Germany. Factors contributing to this economic downturn include a weak yen, an ageing population, and labor shortages1. The Japanese currency dropped by almost a fifth against the US dollar in 2022 and 2023, which affected profits on exports.

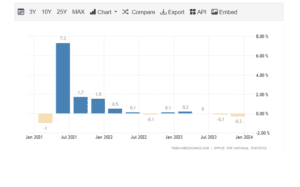

UK Recession Analysis

The UK’s economy fell into a recession in the second half of 2023, with the GDP contracting by 0.3% in Q4, following a 0.1% shrinkage between July and September. This contraction was deeper than economists’ estimates. The economic output is only 1% higher than the pre-COVID level, marking the longest run without growth on record. Despite this, Finance Minister Hunt is optimistic about future improvement. However, the Labour party, which is currently leading in the polls, argues that the government’s plan is not working. This economic backdrop poses a challenge for Prime Minister Rishi Sunak, who has promised to boost growth, ahead of the expected election this year.

Source: Trading Economies

Drop In Living Standards

Sterling depreciated against both the dollar and the euro, reflecting investors’ anticipation of potential interest rate cuts by the Bank of England (BoE) amid calls from businesses for increased government assistance outlined in the upcoming budget on March 6. Despite the UK’s entrance into a recession alongside Japan among the Group of Seven advanced economies, experts anticipate a short-lived and shallow downturn compared to historical standards, with Britain’s economy only marginally surpassing its pre-pandemic levels, ranking poorly among G7 nations. Chancellor Rishi Sunak, who pledged to stimulate economic growth, faces challenges as his party, historically trusted for economic competence, contends with declining popularity compared to Labour on economic matters, potentially leading to the first drop in living standards between consecutive national elections since World War II.

Opinions

The recent Gross Domestic Product (GDP) figures, indicating a technical recession in 2023, carry significant political implications amidst impending by-elections, further complicating Prime Minister Jeremy Hunt’s economic narrative. While Hunt emphasizes adherence to the existing economic strategy of tax cuts to fortify the economy, Labour dismisses these assertions, highlighting the Conservatives’ prolonged period of economic decline and raising concerns over potential cuts in public spending to facilitate pre-election tax reductions. Despite modest growth projections by the BoE, Britain’s economy has stagnated for nearly two years, marked by the most profound contraction on record in early 2020 due to the COVID-19 pandemic, followed by a subdued recovery and subsequent challenges.

No GDP Growth Since 2022

Speculation looms regarding future BoE interest rate cuts, spurred by lower-than-expected inflation in January but tempered by robust wage growth, which underscores the central bank’s cautious approach. While optimism persists for potential rate cuts as early as June, Governor Andrew Bailey emphasizes the need for concrete evidence of easing inflation pressures before such actions. However, with economic output contracting in December, driven by declines in manufacturing, construction, and wholesale sectors, concerns mount over the prolonged stagnation in GDP per capita, the longest recorded since 1955, posing formidable challenges for policymakers navigating the economic landscape.

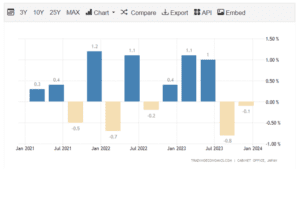

Japan’s Recession Analysis

Japan’s economy, once hailed as an “economic miracle” and the second-largest in the world, has been facing a prolonged period of sluggish growth and recently entered a technical recession. The articles from The Hindu and Bloomberg provide some insights into the reasons behind Japan’s economic struggles.

Source: Trading Economies

Population Decline and Aging Workforce

Firstly, Japan’s population is shrinking and aging, which has resulted in a declining workforce and a shrinking consumer base. This has negatively impacted economic growth, as there are fewer people to drive demand and productivity. In addition to this, Japan’s birth rate is one of the lowest in the world, and the government has been unable to implement effective policies to boost the population.

Another factor is the high inflation that has been crimping domestic demand and private consumption. Despite inflation gradually slowing, the “core core inflation” or inflation minus food and energy prices, has exceeded the Bank of Japan’s 2% target for 15 straight months. This has led to a decrease in consumers’ purchasing power and a decline in private consumption.

Impact of a Weakening Yen

The weak yen has also been contributing to Japan’s economic struggles. The yen has tumbled 6.6% against the US dollar since the start of this year, making imports more expensive and increasing the cost of living in Japan. Germany, on the other hand, has been able to maintain its position as the world’s third-largest economy, despite facing challenges such as rising energy prices and a shortage of skilled labor.

Export Dependency and Sectoral Vulnerability

Japan’s reliance on exports has also been a challenge. While Japan’s economy is powered by strong small and medium-size businesses with solid productivity, the country’s export-driven economy has left it vulnerable to global economic trends. The advent of electric vehicles, for instance, has shaken Japan’s once powerful auto sector, and the country has been slow to adapt to this new technology.

Structural reforms are necessary for Japan to recover from the recession and sustain long-term economic growth. Economists are urging the government to promote women’s participation in the workforce, lower the barriers to foreign investment, and increase investment in research and development. Immigration is also an option for solving Japan’s labor shortage problem, but the country has been relatively unaccepting of foreign labor.

Closure:

The recessions in Japan and the UK can be attributed to a combination of factors, including inflation, supply chain disruptions, and political uncertainty. In Japan, the weakened yen and rising commodity prices have contributed to inflation, while the country’s continued struggle with its aging population and low birthrate have also hampered economic growth. Meanwhile, in the UK, the economic fallout from the COVID-19 pandemic and Brexit have led to supply chain disruptions, labor shortages, and increased costs for businesses, all of which have contributed to the country’s slide into recession.

These challenges are not unique to Japan and the UK, as many other economies around the world are also grappling with similar issues. However, the recent developments in these two countries serve as a reminder of the delicate balance that countries must strike in order to maintain economic stability and growth. As policymakers and business leaders work to address these challenges, they must consider a range of factors, including monetary and fiscal policies, trade agreements, and investment in infrastructure and innovation, in order to promote long-term economic sustainability and resilience.

Read our latest analysis on Rupee vs Dollar

Also Read: Weekend Wrap: How India Performed In The Last Week

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.