After having a mixed response to the ECB’s 50 bps hike and President Lagarde’s comments on the policy outlook, EUR/USD has gotten back on track and is now up for the day above 1.0600. The USD seems to be losing ground because the market’s mood is getting better, which helps the pair move up.

Technical Overview

As worries grow, the EUR/USD pair is under pressure and trading at new daily lows before President Lagarde speaks. Stock markets are going down, which is good for the US Dollar. The pair is once again getting close to 1.0515, which is the 50% retracement of its yearly drop in 2022. Technical readings from the daily chart show that bulls have lost confidence after failing repeatedly around the immediate Fibonacci resistance, the 61.8% retracement at 1.0745. The Momentum indicator is stuck in the middle of its range, and the RSI is pointing south at around 43. This shows that there is no clear direction in the time frame mentioned. At the same time, the pair is still below a 20 Simple Moving Average (SMA) that is slightly bearish and is fighting with a 100 SMA that is slightly bullish.

The 4-hour chart shows that bears have full control of the pair. Bullish moves around the 100 SMA are being pushed back by bears, and the 20 SMA is gaining bearish momentum above the longer one. Technical indicators, on the other hand, are getting more bearish within their negative ranges after correcting overbought conditions. Overall, the odds are more likely to go down, and a break below 1.0515 is likely to speed up the drop.

Support levels: 1.0515 1.0470 1.0420

Resistance levels: 1.0600 1.0640 1.0690

Fundamental Overview

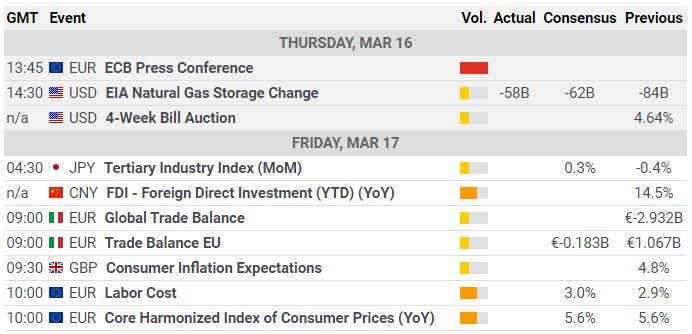

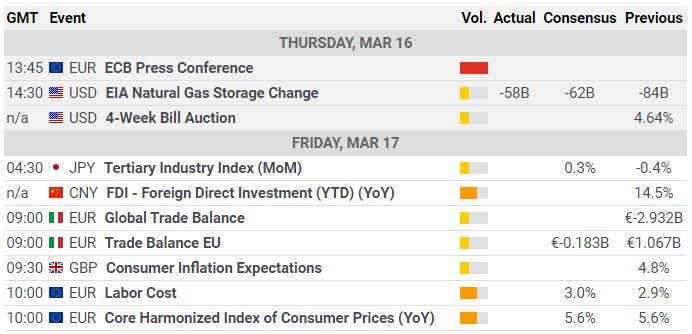

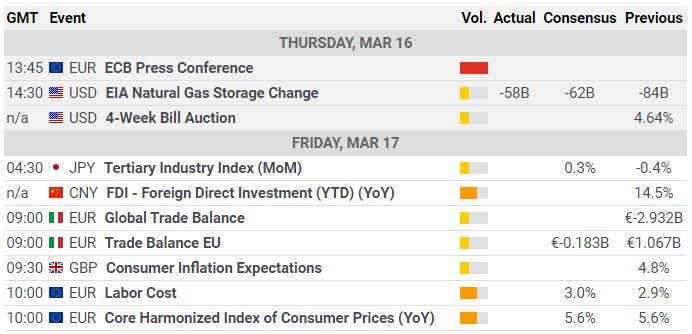

Fears of a European banking crisis caused the EUR/USD pair to fall to 1.0515 on Wednesday. On Thursday morning, it started to rise again. Concerns grew about Credit Suisse after its biggest shareholder said it would not give the bank any more money. Fears of a collapse caused bank stocks to drop, which spread to other industries and caused sharp losses on the European and American stock markets.

But the Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) said late Wednesday that Credit Suisse met the capital requirements for banks and that they will provide liquidity if needed. During London trading hours and before the European Central Bank (ECB) monetary policy announcement, the EUR/USD pair went up to 1.0635.

The rate hikes of 50 basis points (bps) that ECB President Christine Lagarde and her team announced at the last meeting were questioned by the market because aggressive monetary tightening could be partly to blame for the ongoing banking crisis. The sharp rise in global rate benchmarks has caused bond prices to drop, and many of these bonds are held by banks. Also, banks’ profits have been hurt by higher borrowing costs.

Anyway, the ECB announced that it would raise rates by 50 bps, which was what most people expected. If you take out energy and food prices, inflation kept going up in February, and the ECB staff thinks it will average 4.6% in 2023, which is more than they thought in December. Also, growth is expected to speed up to 1.6% in both 2024 and 2025, thanks to a strong job market, higher confidence, and a rise in real incomes. It’s important to remember that “the new macroeconomic projections from the ECB staff were finalised in early March, before the recent tensions on the financial markets.”

The United States also reported that Initial Jobless Claims for the week ending March 10 went up to 192K, which was better than expected. In February, both Building Permits and Housing Starts went up by 13.8%. The Philadelphia Fed Manufacturing Survey for March came in at -23.2, which was worse than the expected -14.5 but better than the previous -24.3.

Source: Team CurrencyVeda