Following the sharp decline witnessed in the European session, EUR/USD has managed to recover modestly and seems to have stabilized above 1.0750 amid an improvement seen in market mood. The pair remains on track to end the week modestly higher.

Technical Overview

EUR/USD broke below the ascending regression channel, and the Relative Strength Index (RSI) indicator on the four-hour chart fell slightly below 60 after staying in the “overbought” zone at the start of Thursday. This suggests that buyers have stopped buying and are now waiting to see what happens next.

Downside support is found at 1.0820, which is the Fibonacci 23.6% retracement of the most recent uptrend and the 20-period Simple Moving Average (SMA). If the pair falls below that level and starts using it as support, the downward correction could continue to 1.0760 (Fibonacci 38.2% retracement) and 1.0720. (50-period SMA).

First resistance is at the static level of 1.0850, followed by the psychological level of 1.0900 and the static level of 1.0930. (multi-week high set on Thursday).

Fundamental Overview

After hitting its highest level since early February at 1.0930 on Thursday, EUR/USD has turned around and dropped below 1.0850. From a technical point of view, the pair is likely to lose some of its bullish momentum in the near future.

During the first half of Thursday’s trading day, there was a lot of selling pressure on the US Dollar, which helped the EUR/USD pair go up. During American trading hours, however, the pair lost steam as Wall Street’s main indexes fell from their session highs. This helped the USD keep its losses to a minimum.

Early on Friday, US stock index futures are almost exactly the same as they were the day before. This shows that risk is not high or low.

Klaas Knot, a policymaker at the European Central Bank (ECB), said on Thursday that he thought rates would go up again in May. “The risks of inflation going up are clear, and second-round effects on wages are becoming more obvious,” said Knot. As the differences between the Federal Reserve’s and the ECB’s outlooks become clearer, EUR/declines USD’s are likely to remain short-term technical corrections.

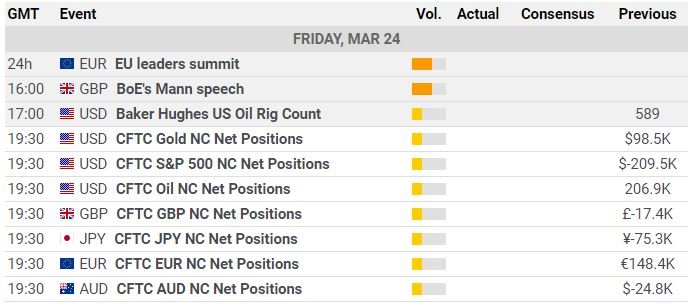

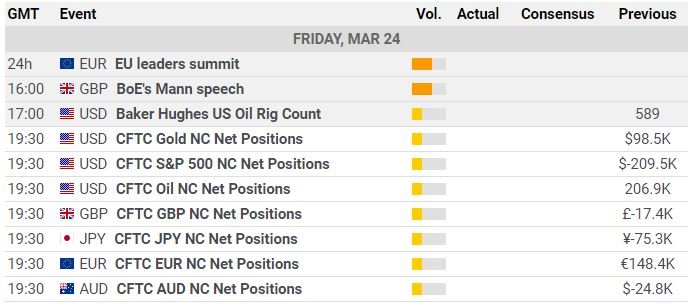

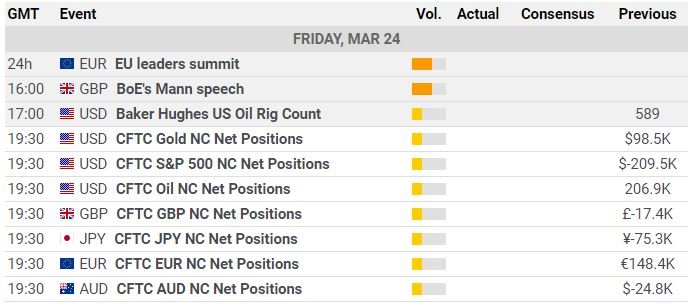

The first March PMI surveys for Germany, the Eurozone, and the US will be released by S&P Global. All three PMIs as a whole are expected to stay in the “expansion” zone, just above 50.

Especially in the service sector, comments about wage inflation are likely to be closely watched by market participants. If the data from Germany and the Eurozone back up what Knot said about how wages are changing, the Euro could stay strong against its competitors.

On the other hand, the USD is likely to get stronger before the weekend if PMI surveys show that salaries in the private sector are going up faster than expected. Still, the way the market thinks about the next Fed policy move isn’t likely to change in a big way, which means the reaction shouldn’t last long. As of this writing, the CME Group FedWatch Tool shows that there is a 33.5% chance that the Fed will raise rates by another 25 basis points in May.

Source: Team CurrencyVeda