Date: June 19, 2023

Place: New Delhi, India

With the conclusion of the recent Federal Open Market Committee (FOMC) meeting, there are indications of a more hawkish stance from the Federal Reserve. Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin expressed concerns about persistent core inflation and suggested that further tightening might be necessary.

However, there is skepticism among market participants, as interest rate futures indicate that the Fed will likely implement one more 25 basis-point increase in July before considering rate cuts as early as next year. All eyes are now on Fed Chair Jerome Powell, who will have the opportunity to justify his hawkish position in his testimony to the US Senate Banking Committee this week. To influence rate expectations, Powell will need to provide stronger conviction that his guidance at the Fed meeting is more than mere rhetoric.

Today, the US market is closed in observance of the Juneteenth holiday, which could lead to a quiet start to the trading week for global markets. Last Friday, Treasury yields remained steady, with the two-year and ten-year yields increasing by 8 and 5 basis points, respectively. This stabilization allowed the US dollar to recover slightly from the recent post-Fed sell-off. It will be worth watching the price of silver, as it experienced some buying activity last week, showing support at key levels on the daily chart. The US$24.70 level is the next resistance to overcome, while a breakdown of the rising channel pattern may indicate a decline toward the US$23.00 level.

Turning to Asia, the market open looks mixed, with the Nikkei down 0.38%, ASX up 0.24%, and KOSPI down 0.70% at the time of writing. The recent visit of US Secretary of State Antony Blinken to Beijing has garnered attention, with “candid” and “constructive” talks held on Sunday, indicating a willingness to cooperate. However, it remains to be seen whether this will lead to any tangible positive outcomes, as inaction on that front could dampen optimism.

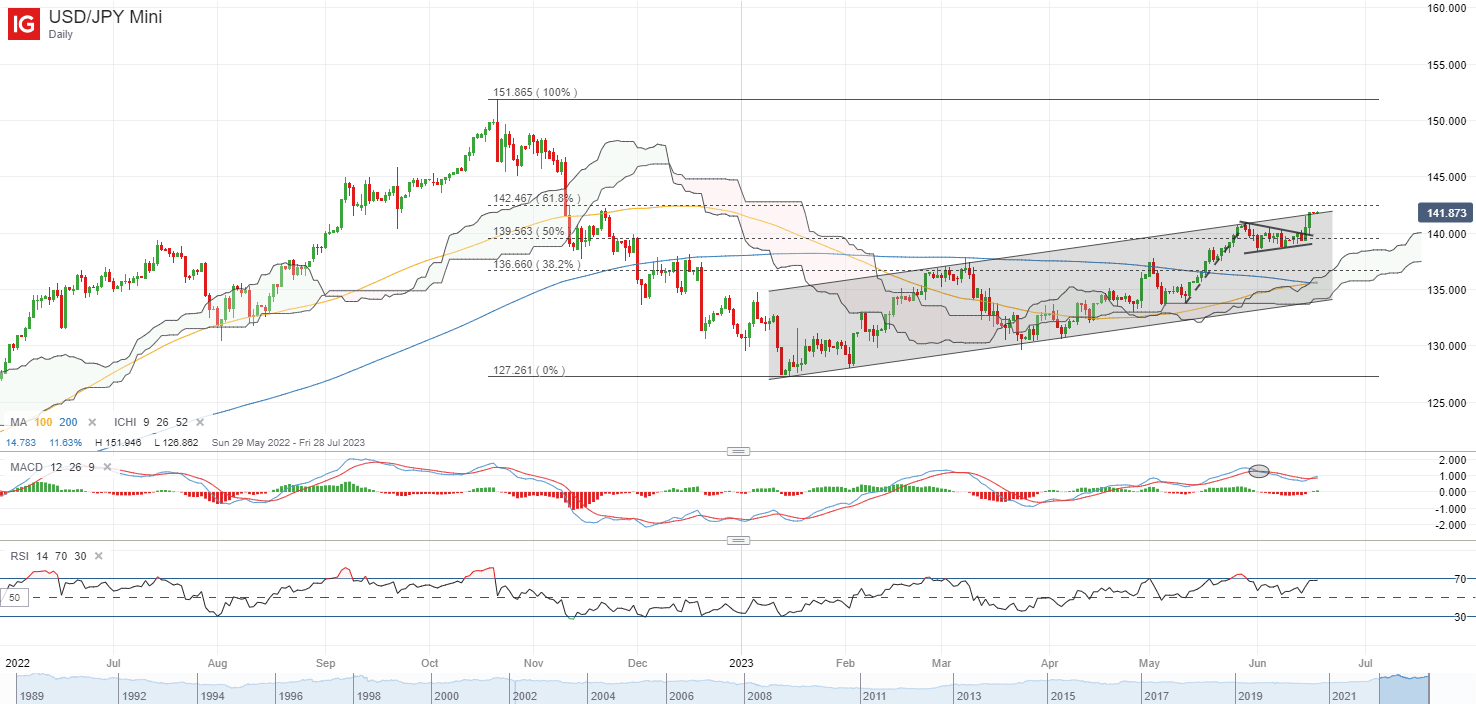

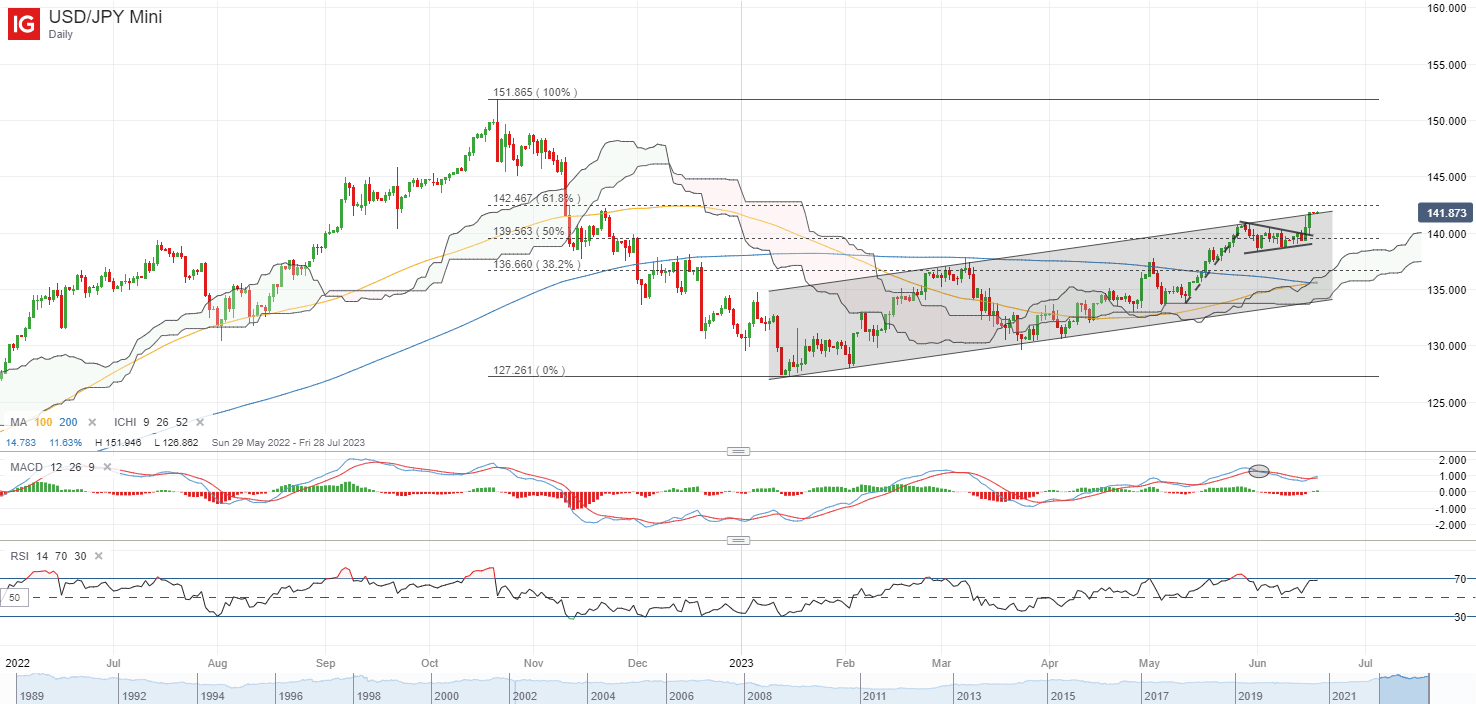

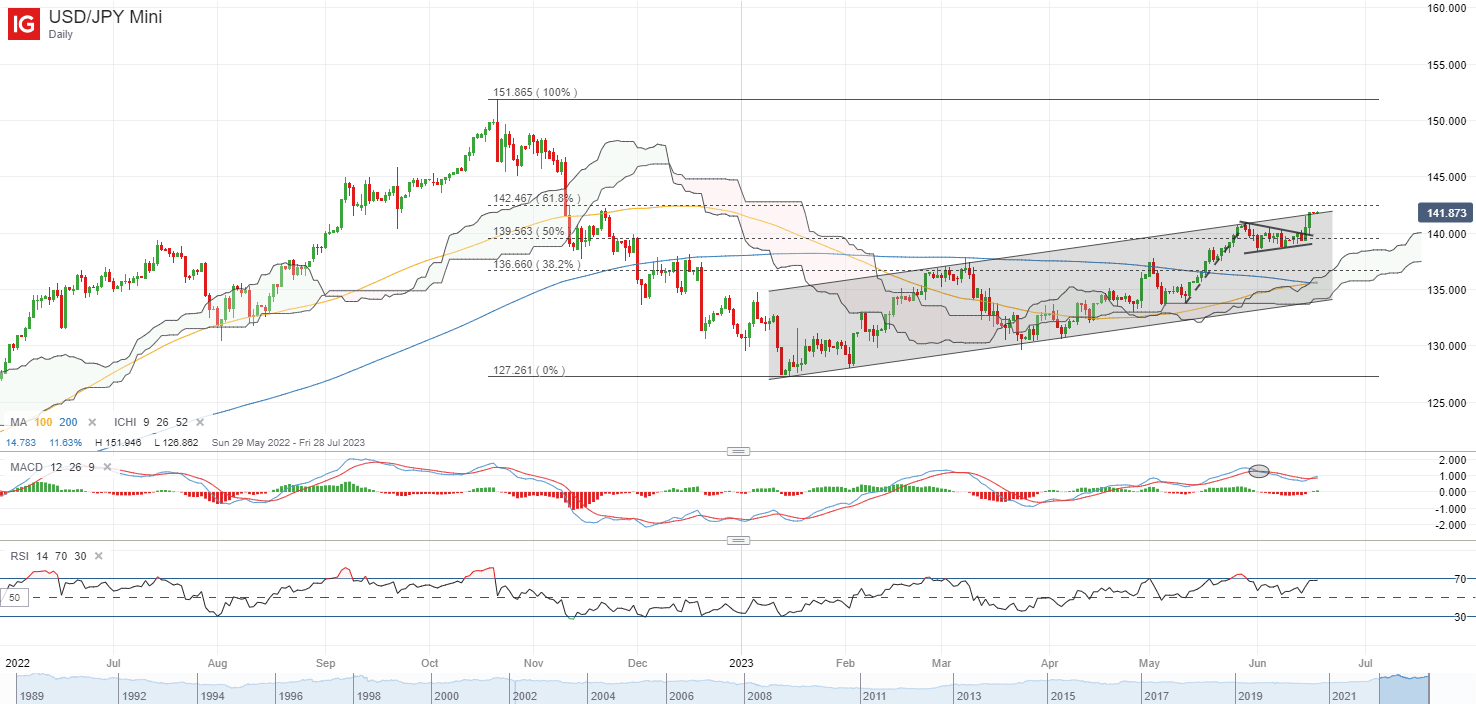

Last week, the Bank of Japan (BoJ) kept interest rates unchanged, as widely expected, and maintained its yield curve control policy. Unless there is an unexpected adjustment similar to what happened in December last year, the BoJ’s view that inflation will slow over the coming months suggests that any changes to their policy will take time. The USD/JPY currency pair is currently testing an upper channel trendline resistance, and a successful breakthrough could bring the 145.20 level into focus.

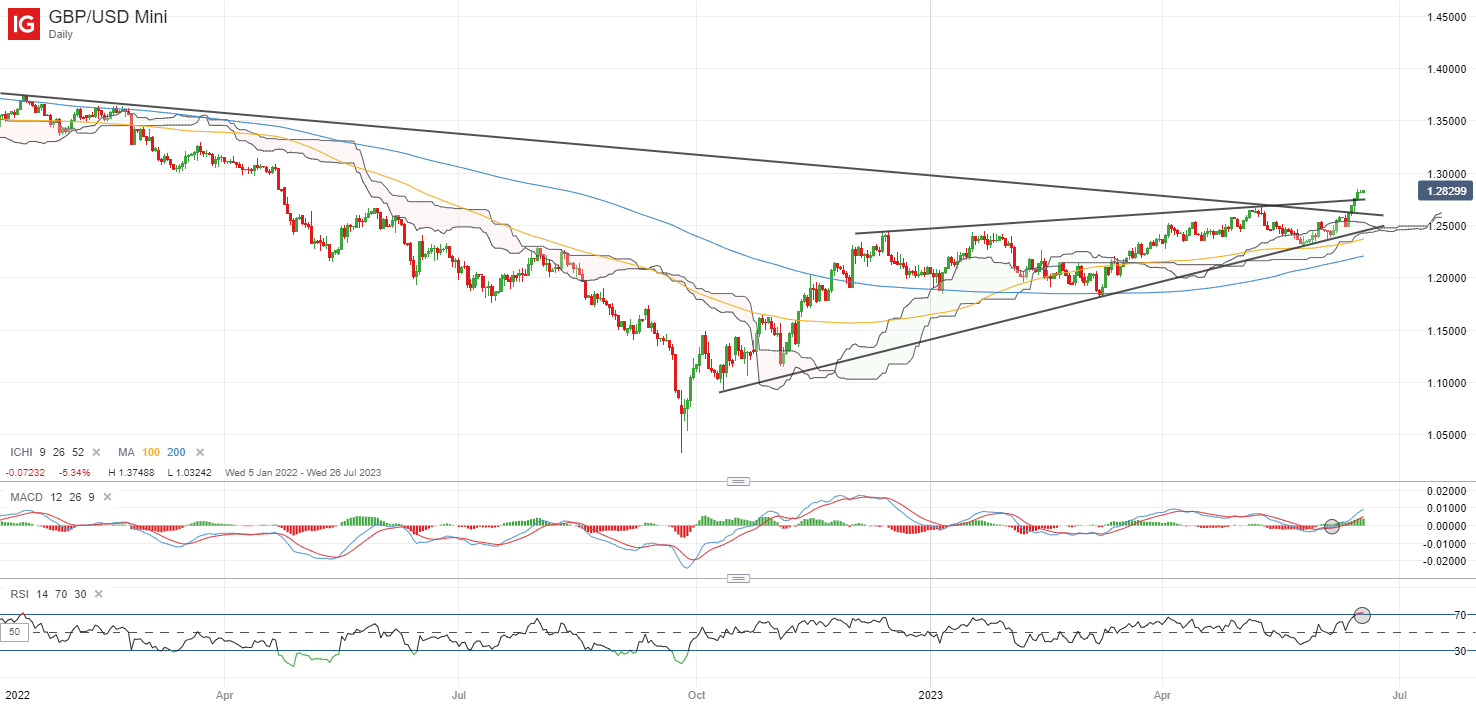

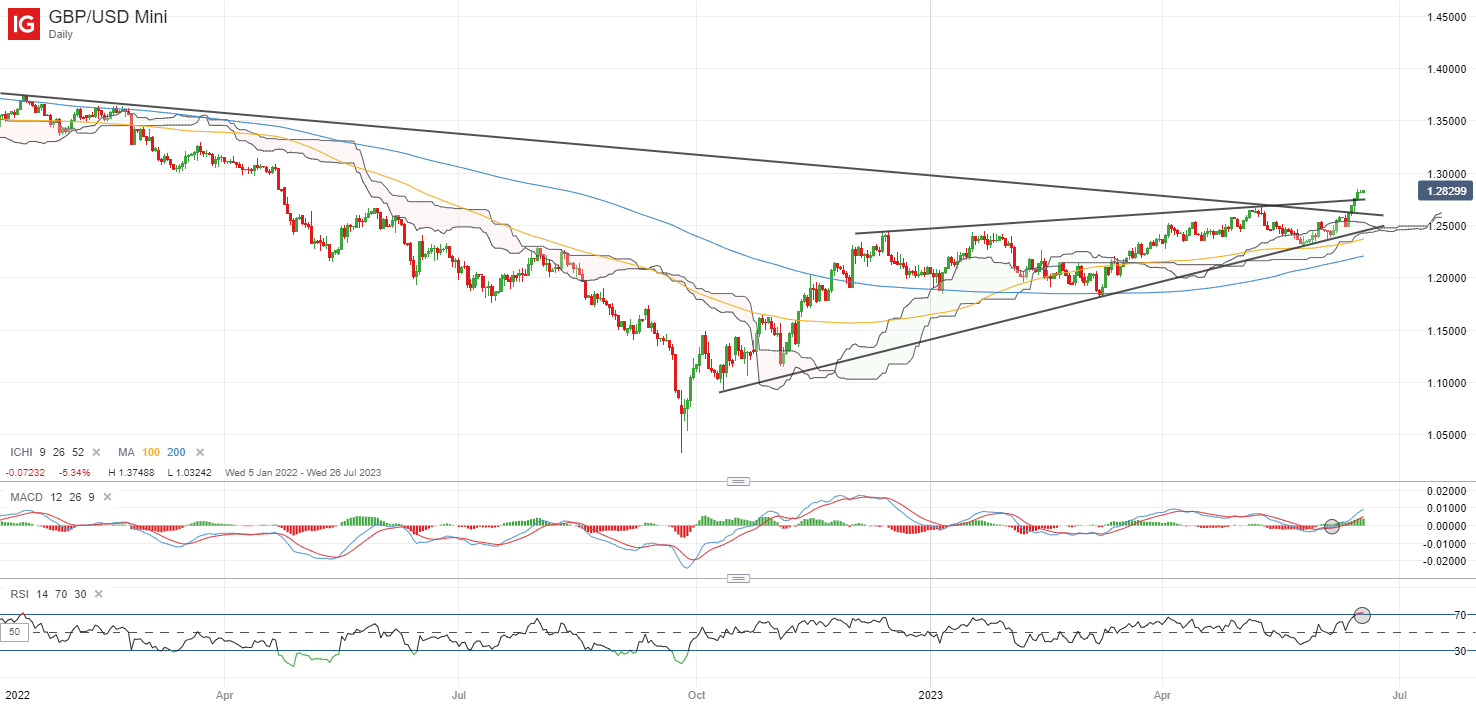

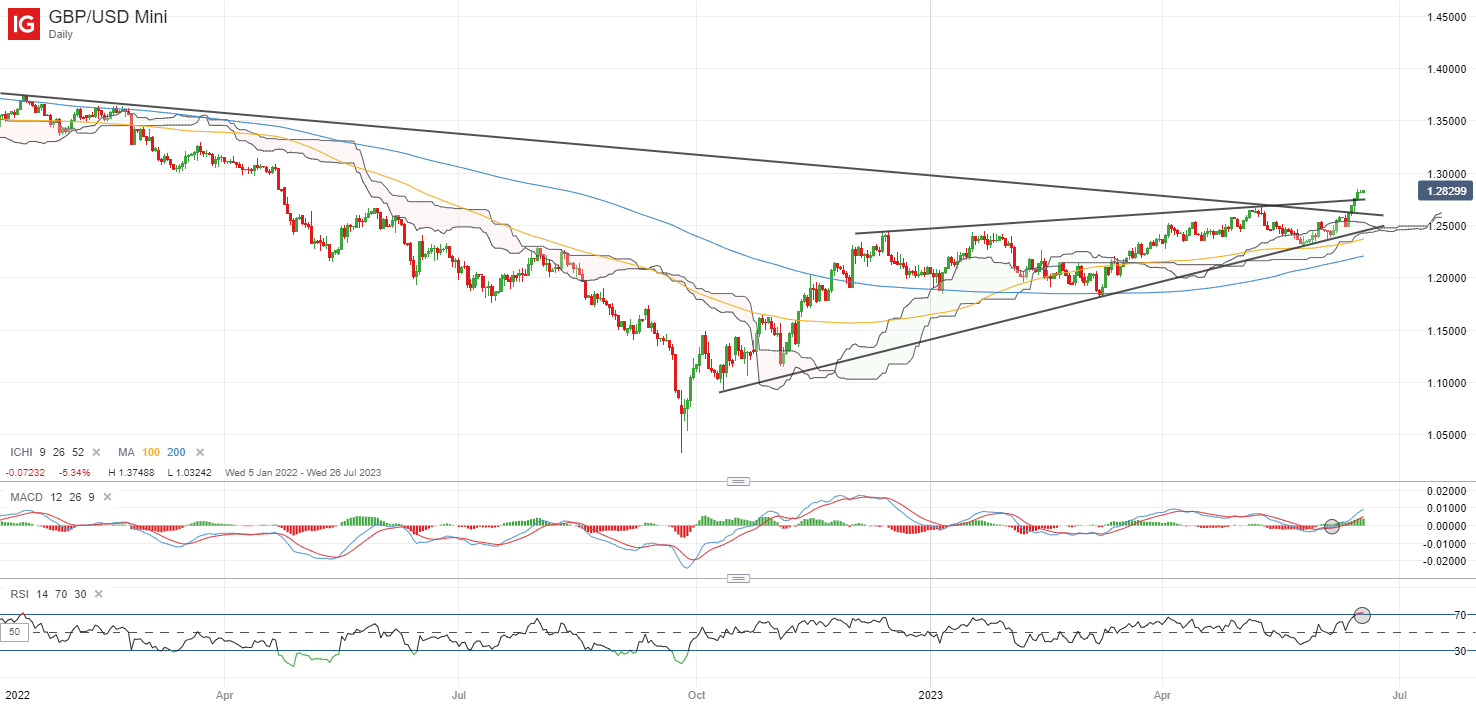

Looking ahead, the focus shifts to the Bank of England (BoE) meeting this week. Persistent inflationary pressures in the UK have led to expectations of further interest rate hikes by the BoE. The markets anticipate a relentless upward trajectory of rates, with around 125 basis points of tightening expected in the coming months. In April, UK core inflation reached its highest level since records began in 1992, creating a stark contrast to the expectations of a final 25 basis-point hike by the Fed in July. This policy divergence may propel the GBP/USD currency pair to its 13-month high. If the BoE validates expectations by signaling a higher-for-longer approach to rates, it could provide further upside potential for the GBP.

Recent price movements in the GBP/USD pair have resulted in a breakout from a rising wedge pattern on the daily chart, accompanied by a break of a key downward trendline resistance that has been in place since June 2021. The Relative Strength Index (RSI) is above the key level of 50, indicating upward momentum, while the Moving Average Convergence Divergence (MACD) is showing increasing positive momentum. The formation of higher highs and higher lows suggests an overall upward trend, with the next level of interest at 1.316 for a potential retest. On the downside, there are several support levels to watch, including the 200-day moving average, the Ichimoku cloud, and the lower wedge trendline, with immediate support at the 1.265 level.

Disclaimer: The information provided by CurrencyVeda is intended for educational purposes only and should not be considered as financial advice or a recommendation to engage in any trading or investment activities. It is essential to conduct thorough research and seek professional advice before making any financial decisions. CurrencyVeda shall not be held responsible for any losses or damages arising from the use of the provided information.