Date: June 21, 2023

Place: New Delhi, India

Major US indices started the shortened trading week with declines. The Dow Jones Industrial Average (DJIA) dropped by 0.72%, the S&P 500 by 0.47%, and the Nasdaq by 0.16%. However, the Nasdaq showed some strength as losses were pared mid-day, indicating potential buyer interest. The energy sector was the main drag on market performance, declining by 2.3% due to a dip in oil prices. On the other hand, the consumer discretionary sector saw a 5.3% gain attributed to Tesla’s performance.

In the next two days, Fed Chair Jerome Powell will be in the spotlight. He will present his report on monetary policy and the economy to the House Financial Services Committee today, followed by testimony to the Senate Banking Committee tomorrow. While Powell is likely to retain a hawkish tone, market participants have recently shown scepticism towards the Fed’s guidance. This puts pressure on Powell to provide convincing support for his rate outlook.

The upcoming UK inflation numbers will also be closely watched. Expectations suggest a slight decrease in the headline inflation rate to 8.4% (previously 8.7%), while the core aspect is expected to remain unchanged at 6.8% year-on-year. Persistent inflation may reinforce a hawkish stance from the Bank of England (BoE), which has expressed concerns about the progress in its inflation fight.

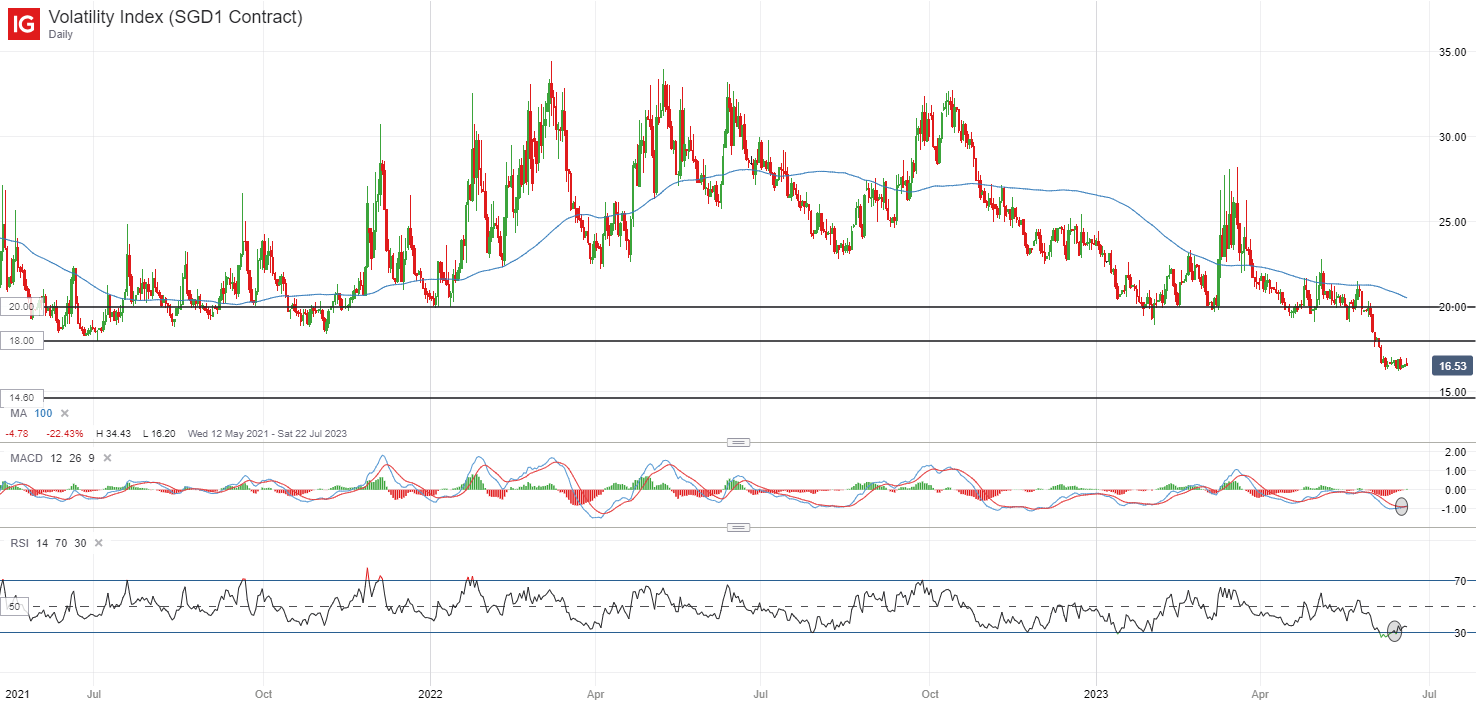

The VIX, a measure of market volatility, has been struggling to increase and currently sits at its lowest level since February 2020. After a 17% decline since the beginning of the month, the index has been moving sideways in the short term, displaying a flat-lined moving average convergence/divergence (MACD) on the daily chart. Although some attempts to stabilize can be observed, a catalyst for a sustained upward move is still lacking. Historical seasonality suggests that the VIX tends to see more significant gains from late July to early October. In the near term, a move above the 18.00 level could provide conviction for retesting the key 20.00 level.

In Asia, stock markets are expected to have a subdued opening. At the time of writing, the Nikkei is up 0.23%, the ASX is down 0.16%, and the KOSPI is down 0.29%. Chinese equities struggled to gain momentum despite rate cuts by the People’s Bank of China (PBOC), as market participants anticipate further measures. The Nasdaq Golden Dragon China Index plummeted by 4.9%, and the Hang Seng Index retreated from its psychologically significant 20,000 level. The recent leadership change at Alibaba highlights the challenging environment for Chinese companies, despite regulatory risks taking a backseat and reopening efforts. Early export numbers from South Korea indicated a 5.3% year-on-year gain, but weakness in semiconductors and petroleum products dampened enthusiasm.

The Nikkei 225 index has maintained some strength in today’s session. The Relative Strength Index (RSI) has moved from overbought to more neutral territory without a significant dip. Although a bearish crossover is present on the MACD, previous attempts at a bearish cross have resulted in bear traps, casting doubt on its reliability as a guide.

The 20-day moving average (MA) is worth monitoring as it has provided consistent support for the index over the past two months. With the overall upward trend intact, any retracement could potentially form a higher low, possibly around the 32,000 level.

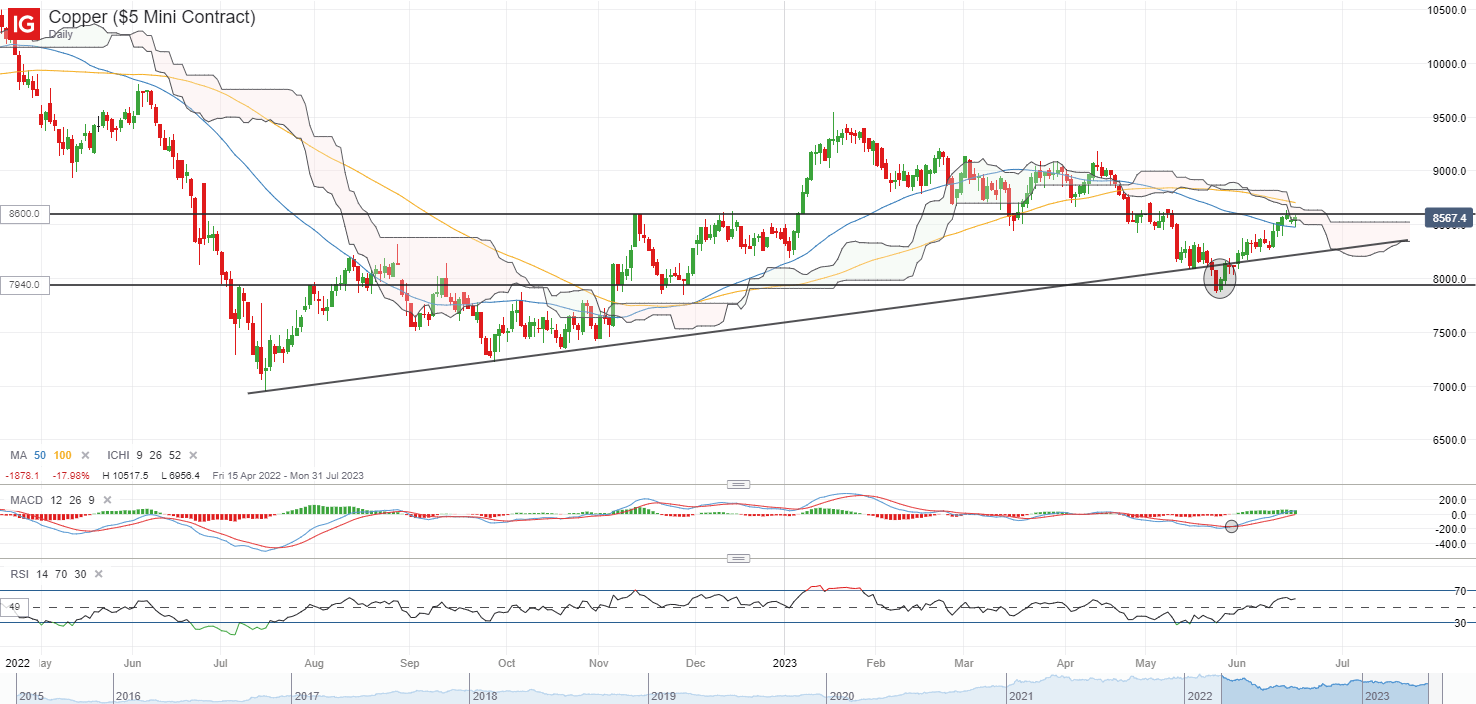

On the watchlist is copper prices, which are testing resistance at the US$8,600/tonne level. Recent positive reactions to China’s policy-easing efforts have led to a recovery of approximately 10% since late May.

To Sum Up

US indices opened the shortened trading week in the red, with the energy sector experiencing a major decline. However, the Nasdaq showed some strength as losses were pared mid-day. Fed Chair Jerome Powell will deliver his report on monetary policy and the economy to the House Financial Services Committee and the Senate Banking Committee, with market participants looking for conviction in his rate outlook. UK inflation numbers are expected to tick lower, potentially reinforcing a hawkish tone from the Bank of England. The VIX, a measure of market volatility, remains at its lowest level since February 2020. Asian markets are set for a subdued open, and copper prices are testing a key resistance level.

Disclaimer

CurrencyVeda is an educational information provider. The content provided is for educational purposes only and should not be considered financial or investment advice. It is important to conduct thorough research and seek professional guidance before making any financial decisions. CurrencyVeda does not guarantee the accuracy or completeness of the information provided.