- For the third day running, AUD/USD has increased and has reached a one-week high.

- The positive Australian jobs report and the declining value of the US dollar help the pair.

- The USD drops to a two-month low due to expectations of an impending Fed rate hike.

Building on this week’s recovery from the 0.6620 region, or the monthly low, the AUD/USD pair experiences positive movement for a third straight day on Thursday. During the first half of the European session, the momentum propels spot prices to a level above a week high, in the 0.6735 area, and is supported by a number of factors.

The positive domestic jobs statistics, which revealed that the unemployment rate held close to a 50-year low of 3.5% and the number of employed individuals increased by 53K in March, more than the 20K projected, is helping to boost the Australian Dollar. The markets have begun pricing in the potential of a 25 basis point rate increase at the Reserve Bank of Australia’s (RBA) upcoming meeting in May, which, combined with the general bearishness towards the US Dollar, gives the AUD/USD pair a slight lift.

In reality, as the Federal Reserve (Fedrate-hiking )’s cycle draws to a close, the USD Index, which measures the value of the dollar against a basket of currencies, falls to its lowest level since early February. The odds were reinforced by the softer-than-anticipated US consumer inflation figures released on Wednesday, which gave rise to hopes that the disinflation is proceeding without difficulty and may even quicken, potentially paving the way for the Fed to lower interest rates in the second half of the year.

Also, the minutes of the FOMC meeting in March revealed that numerous decision-makers discussed postponing interest rate rises following the bankruptcy of two regional banks. The US Treasury bond yields remain low as a result, which further weakens the US dollar. As concerns over a downturn in the Chinese economy could cap the Aussie, this, to a larger extent, overshadows impending recession threats and maintains the bullish tone surrounding the AUD/USD pair.

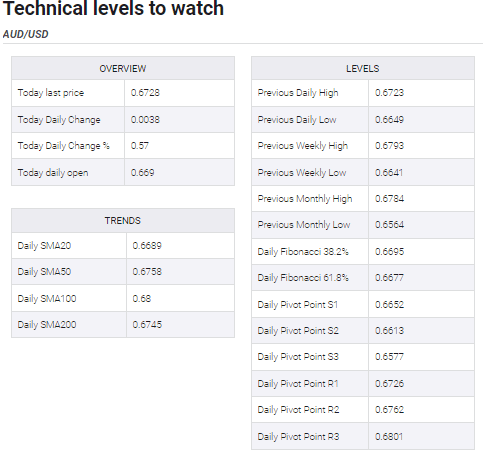

Technically speaking, bullish traders are likely to wait for continued rise above the 0.6745 confluence, which is formed by the 200-day and 50-day Simple Moving Averages (SMAs). The 100-day SMA, which if cleared will be considered as a new trigger for bullish traders and lay the ground for more advances, is closely behind this. For some trading inspiration, market participants are currently watching the US economic calendar, which includes the Producer Price Index (PPI) and Weekly Jobless Claims.