MUMBAI: Banks worry that the implementation of tax collected at source (TCS) on such transactions may result in a decline in the use of cards for cross-border transactions. Some people claimed that this went against the prior goal of greater capital account convertibility.

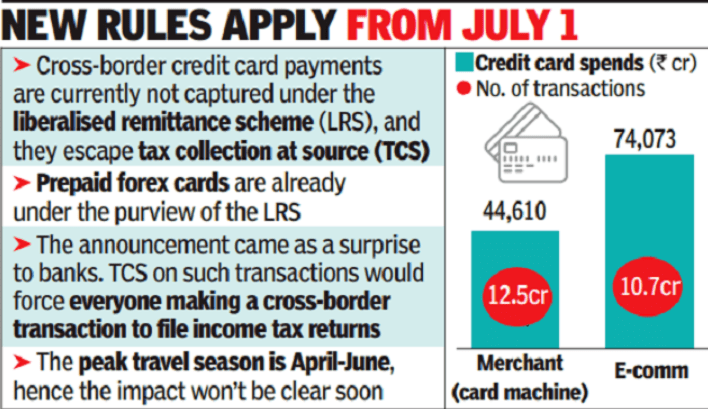

Cross-border credit card payments are now excluded from the LRS and the TCS, according to finance minister Nirmala Sitharaman, who was speaking on the Finance Bill 2023 in the Lok Sabha. According to the finance minister, the Reserve Bank of India (RBI) would take action to guarantee that these transactions fall under TCS’s purview.

The banks were taken aback by the statement. A senior banker told TOI that the tax authorities may already access information on offshore transactions and can use it. The TCS on such transactions would compel everyone engaging in cross-border commerce to submit returns.

According to Sandeep Ghosh, group country manager for Visa in India and South Asia, “Credit and debit cards are mostly utilised for personal consumer expenditure and not for remittances.” In recent years, he continued, there had been a major change in cross-border payments from cash to cards and digital payments.

The TCS for foreign card payments may prevent people from using cards for these kinds of purchases. As a sector, we would be eager to collaborate closely with the government to comprehend and contribute to the resolution of the problem they intend to address with this action, said Ghosh.

“The tax collection at source on the purchase of prepaid forex cards had already been under the purview of LRS, while the same is now applicable even on rupee-denominated card spends for overseas travel-related payments,” said M. Hariprasad, executive director and business head of Ebixcash World Money.

Although the new TCS regulation will go into effect on July 1st, the main outbound leisure travel season is from April to June, so it may be difficult to predict any negative effects right once, he continued.

According to bankers, not just the wealthy make international transfers. Cross-border payments for software, internet services, educational materials, and online courses are made via credit cards. Some foreign exchange money changers assert that an increase in the activities of unauthorised money changers could result from the tax collection.