Overview of the UK CPIs

The Consumer Price Index (CPI) for the UK’s February month is scheduled to be released early on Wednesday at 7:00 GMT.

The Bank of England’s (BOE) next movements are uncertain in light of the recently disclosed mixed job statistics, firmer economic activity numbers, and other factors, thus today’s British inflation data will be eagerly followed by GBP/USD traders. The impending banking crisis and the policymakers’ desire for measures that could aid the market in mitigating the risks further heighten the significance of the UK CPI.

Nevertheless, the headline CPI inflation is anticipated to ease to 9.8% YoY in February from the previous 10.1% while continuing to decrease from the 41-year peak established in October. In addition, the Core CPI, which does not include erratic food and energy prices, is expected to hold steady at around 5.8%. In terms of the monthly numbers, the CPI may increase to 0.6% from -0.6% previously.

The Retail Price Index (RPI) numbers for February should be closely monitored since they are predicted to increase by 0.6% MoM and decrease by 13.2% YoY, compared to 0.0% and 13.4% in that order.

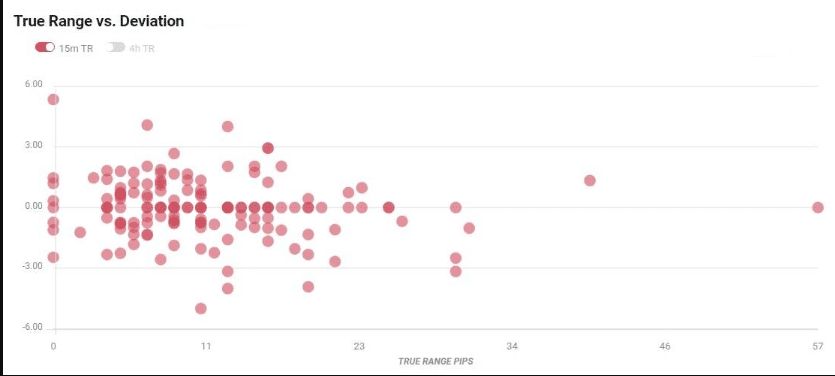

GBP/USD is impacted by deviation

Below is a map of the event’s exclusive deviation impact provided by FXStreet. In deviations up to + or -3, the reaction is likely to stay within the range of 20 pips as witnessed, while in some instances, if the divergence is significant enough, it may spark movements of more than 50 or 60 pips.

How might it impact GBP/USD?

As optimism about the UK’s economic recovery and the most recent rumours that UK PM Rishi Sunak will be able to persuade the European Research Group (ERG) and the Democratic Unionist party (DUP) to support his extremely difficult Brexit deal, GBP/USD picks up bids to reverse the previous day’s pullback from a seven-week high. The US Dollar’s deterioration prior to the crucial Federal Open Market Committee (FOMC) monetary policy meeting can strengthen the recovery efforts.

Yet, the recent improvement in British statistics, anticipation that the labour market issues will be resolved, and softer UK inflation data may help the GBP/USD bears regain the upper hand. But, with the Fed’s decision and the UK House of Commons vote on the Brexit bill looming, the UK CPI may have less significance for the cable traders this time. Even so, the Bank of England (BoE) is prepared for the last hawkish dance, so a good UK inflation data won’t hesitate to delight Cable pair buyers.

Technically, the GBP/USD bulls applauding a sustained break of the 50-DMA barrier surrounding 1.2145 are up against a four-month-old horizontal resistance level about 1.2270-90.

Important points

1.2200 resistance level for GBP/USD, UK inflation, Brexit vote, and Fed focus

GBP/USD Price analysis: Supported by the 50-DMA, it rises again above 1.2200.

About the UK CPIs

The Office for National Statistics’s Consumer Price Index serves as a gauge of price changes by contrasting the retail costs of a sample shopping basket of goods and services. Inflation reduces the value of the GBP in terms of purchasing power. The CPI is a crucial statistic for gauging inflation and shifts in consumer behaviour. In general, a high value is considered favourable (or bullish) for the pound, while a low number is considered unfavourable (or Bearish).