- After gaining the most since May 2022 the day before, WTI crude oil is grinding around a two-week high.

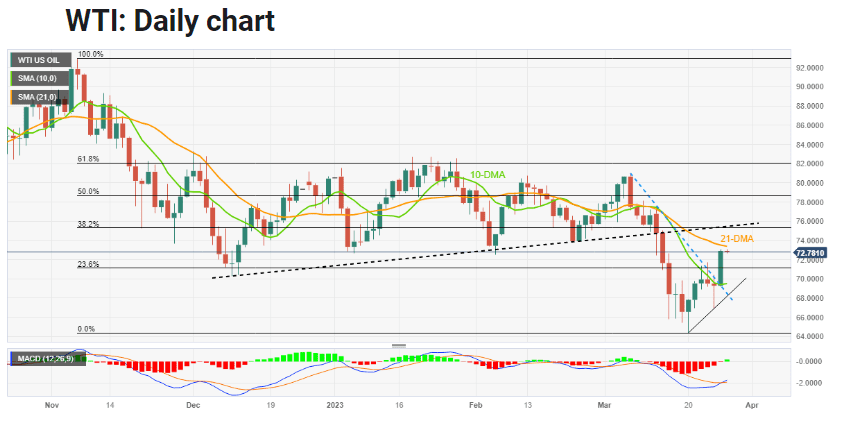

- Three-week-old falling trend line and clear break of the 10-DMA keep buyers optimistic.

- Upward progress is hampered by the 21-DMA and a previous resistance line from December 2022.

- Oil buyers are encouraged by bullish MACD indications, and a one-week-old rising trend line strengthens the downside protection.

Following the largest daily increase in ten months, bulls take a pause as WTI crude oil records slight losses below $73.00. In doing so, the Oil traders find it difficult to celebrate the upside breakout of the 10-DMA and three-week-old descending trend line from the previous day.

Yet, the bullish MACD signals and consistent trading beyond the ascending trend line that has been in place for one week allow WTI crude oil buyers to pass the nearby 21-DMA barrier at $73.40.

However, the prior support line from last December, which is currently resistance at $75.50, appears to be the primary obstacle that the Oil Bulls must overcome before aiming for the driver’s seat.

After that, a move up towards the monthly high of about $80.00 is not completely out of the question.

Contrarily, the $70.00 limit the WTI crude oil’s immediate decline before pointing the $69.50 10-DMA support.

The convergence of the one-week-old rising trend line and the previous resistance line from March 07, which is close to $68.20, becomes essential for the Oil bears to defeat should the price of black gold fall below $69.50.

Despite the most recent inaction, oil price generally regains buyers’ interest.