- Around $1,960.00, the gold price is running into trouble because Fed Powell is expecting one more rate walk.

- Fed Chairman Jerome Powell and US lawmakers have talked about raising the limits on insurance after SVB and Signature Bank failed.

- Even though there are no possible triggers, the gold price is becoming much less volatile.

In the Asian session, the gold price (XAU/USD) has hit a wall near $1,960. The precious metal’s auction price has dropped below $1,960. This is due to fewer worries about the U.S. banking system and a greater chance that the Federal Reserve will raise interest rates again (Fed).

After strong buying on Wednesday, S&P500 futures haven’t lost much during the Tokyo session. This shows that the market as a whole is optimistic, but caution has grown after comments from Fed chair Jerome Powell.

When asked in a private meeting with US lawmakers about how many more times the central bank will raise interest rates this year, Fed Powell said there will be one more. This was reported by Republican Representative Kevin Hern through Bloomberg.

The US Dollar Index (DXY) has been going up again and is now hovering around 102.77, which was its high on Wednesday. The USD Index wants to keep going up on hopes that the Fed will become more hawkish.

At the same time, the US government’s efforts to convince investors that the banking system is “sound and resilient” have made Gold less attractive as a safe place to put money. Fed Powell and US lawmakers have talked about how important it is to raise insurance limits after Silicon Valley Bank (SVB) and Signature Bank failed. The Federal Deposit Insurance Corporation (FDIC) covers up to $250,000 per depositor at the moment.

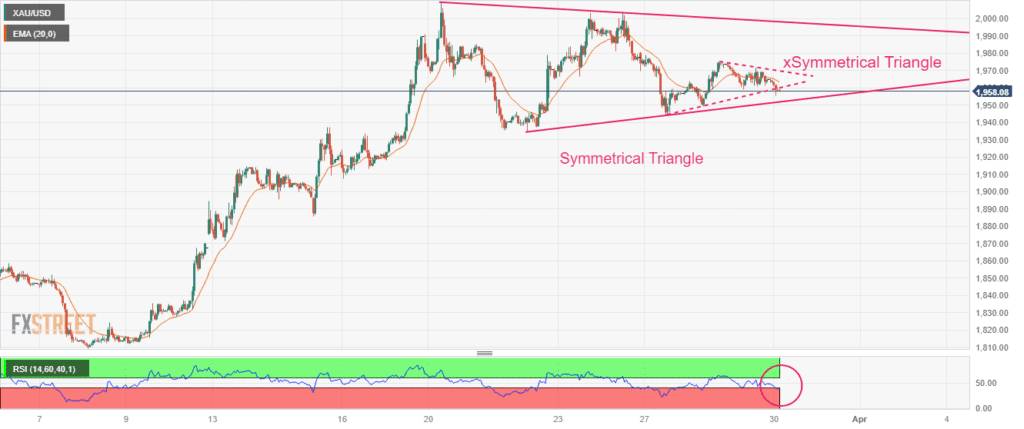

Technical analysis of gold

Even though there are no possible triggers, the gold price is becoming much less volatile. On an hourly scale, the asset is being sold in a Symmetrical Triangle chart pattern. The chart pattern’s upward-sloping trendline is drawn from the low on March 22 at $1,934.34, and the downward-sloping trendline is drawn from the high on March 20 at $2,009.88.

Inside the larger triangle, a small xSymmetrical Triangle is starting to form. This shows that power is building up for a decisive move.

Gold’s price has fallen below the 20-period Exponential Moving Average (EMA), which is $1,963.66, indicating a short-term downward trend.

The Relative Strength Index (RSI) (14) has moved into the range of 20.00-40.00, which is a sign of weakness. The lack of divergence and oversold signals makes it more likely that prices will go down.

Gold hourly chart

XAU/USD