September 13, 2024

New Delhi, India

Currency Market News

USDINR

The Rupee ended nearly flat as intervention by the Reserve Bank of India helped stabilize the currency. India’s annual inflation rate rose slightly to 3.65% in August 2024 from 3.6% in July. Despite this, India’s robust growth prospects and consumption demand remain strong.

EURINR

The Euro declined as German wholesale prices saw their largest drop in four months. The European Central Bank reduced its main interest rate by 0.25%, bringing it down to 3.5%. Meanwhile, producer prices in the Euro Area increased by 0.8% month-over-month in July 2024, marking the largest rise since December 2022.

GBPINR

The GBP weakened as Britain’s economy unexpectedly stagnated in July, with manufacturing output falling. The country’s GDP stalled for the second consecutive month, and industrial production unexpectedly shrank by 0.8%. However, the unemployment rate slightly decreased to 4.1%, with the economy adding 265,000 jobs.

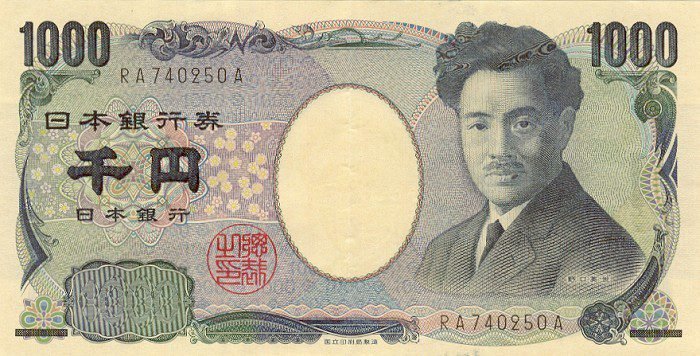

JPYINR

The JPY eased as the U.S. dollar strengthened following a mixed U.S. consumer inflation report. Bank of Japan board member Naoki Tamura indicated that the central bank must raise interest rates to at least 1% by late 2025. Additionally, producer prices in Japan increased by 2.5% year-on-year in August 2024.

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.