September 23, 2024

New Delhi, India

USDINR

The Indian Rupee hit a two-month high after the Federal Reserve delivered a significant 50 basis points interest rate cut. Fed Chair Jerome Powell stated that the cut aims to support sustained low unemployment now that inflation has eased. Meanwhile, dollar-rupee forward premiums surged, with the 1-year implied yield reaching 2.33%, its highest level since April 2023, reflecting positive sentiment in the forward market.

Euro Appreciates as Fed Cuts Rates

EURINR

The Euro appreciated following the US Federal Reserve’s jumbo 50bps interest rate cut, boosting investor confidence in the Euro. In the Euro Area, the current account surplus widened sharply to €48 billion in July 2024, up from €25.5 billion a year earlier. Furthermore, the annual inflation rate in the Eurozone eased to 2.2% in August 2024, marking the lowest rate since July 2021, as inflationary pressures gradually subsided.

British Pound Gains After BoE Holds Rates

GBPINR

The British Pound gained momentum after the Bank of England left interest rates steady at 5.5%, in line with market expectations. The UK’s annual inflation rate remained unchanged at 2.2% in August 2024, the same level as in July. Traders are now anticipating about 42bps of rate cuts by the BoE by the end of the year, down from previous expectations of 52bps before the central bank’s decision.

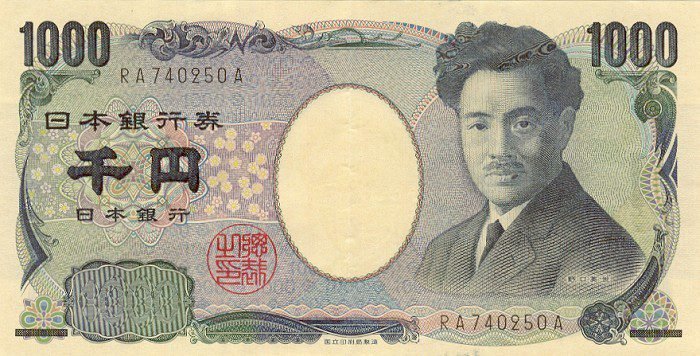

Yen Falls Despite Fed’s Rate Cut

JPYINR

The Japanese Yen weakened, despite the US Federal Reserve delivering a supersized half-percentage point interest rate cut. Fed Chair Powell emphasized that the central bank is not in a rush to ease policy further, signaling that the 50bps rate cuts do not represent a new norm. The Bank of Japan is expected to maintain its policy unchanged in the upcoming meeting but may signal potential rate hikes in the near future, adding further pressure on the Yen.

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.