August 29, 2024

New Delhi, India

Berkshire Hathaway

Berkshire Hathaway has made history by becoming the first U.S. company outside the technology sector to surpass a $1 trillion market capitalization. This landmark achievement was reached on Wednesday, with the company’s shares rising by 0.8% to push its market value above $1 trillion for the first time.

In 2024, Berkshire Hathaway’s stock has climbed by 30%, significantly outperforming the S&P 500, which has gained 18% this year. This remarkable increase has added over $200 billion to the company’s market value, setting a new record for the firm.

Joining an Elite Group

Berkshire Hathaway now joins an exclusive group of companies with a $1 trillion valuation, a group that has previously been dominated by technology giants such as Alphabet Inc., Meta Platforms Inc., and Nvidia Corp. Despite not being a tech firm, Berkshire’s performance is close to the top tech stocks, which have risen by 35% this year.

Also Read: Paytm Shares Rise After Government Nod for Downstream Investment in Payment Services Arm

Strong Financial Performance

The company’s success is highlighted by its recent financial results. Berkshire Hathaway reported a record quarterly profit of $11.22 billion in the first quarter of 2024, driven by a 39% increase in income from its insurance underwriting business. However, the company’s net income for the quarter fell to $12.7 billion from $35.5 billion the previous year due to accounting rules affecting unrealized gains and losses from its investments.

Strategic Moves and Cash Reserves

Berkshire Hathaway has also increased its cash reserves to about $276.9 billion, partly due to a reduction in its stake in Apple Inc. This decision surprised many, given Apple’s significance in Berkshire’s investment portfolio. Despite this, Apple CEO Tim Cook has expressed appreciation for Berkshire’s continued support.

Also Read: Gold Prices Edge Above $2,500 Amid Fed Rate Cut Speculation and Middle East Tensions

Impact of Economic Conditions

The milestone comes amid optimism about the U.S. economy, with consumer confidence reaching a six-month high. However, potential interest rate cuts by the Federal Reserve could affect returns on Berkshire’s substantial cash reserves.

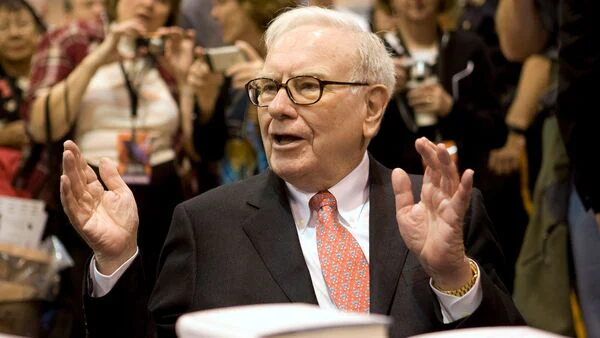

Warren Buffett’s Leadership

The achievement is a testament to Warren Buffett’s enduring investment strategy. As the company’s shares rose just before Buffett’s 94th birthday, it underscores his remarkable influence in shaping Berkshire Hathaway’s success.

Berkshire Hathaway’s rise to a $1 trillion market cap reflects its robust financial health and strategic management, marking a significant moment in financial history.

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.