February 29, 2023

New Delhi, India

Recent developments in the US and Indian economies have significant implications for the USD/INR rate. With revisions in US fourth quarter GDP and forecasts for Indian GDP growth, investors closely monitor these indicators. Let’s analyze the impact of these updates on the currency pair.

US Fourth Quarter GDP Revision

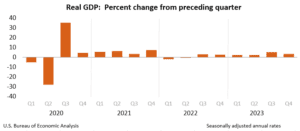

The US economy experienced a slight downward revision in fourth quarter GDP growth, settling at a 3.2% annual rate compared to the initial estimate of 3.3%. This adjustment, attributed to decreased business investment, underscores nuances in economic performance.

Source: Bureau of economic analysis(U.S department of commerce)

Indian GDP Expectations

India anticipates a slowdown in GDP growth for October-December 2023, projected to decrease to 6.5% from the previous quarter’s 7.6%. The Statistics Ministry’s release of this data is awaited, with potential implications for market sentiments and currency movements.

USD/INR Exchange Rate Dynamics

The Indian Rupee (INR) faces pressure against the US Dollar (USD) amidst rising month-end demand. Speculations arise regarding the Reserve Bank of India’s (RBI) intervention in currency markets. However, the INR finds support from robust economic fundamentals and reduced oil prices.

Read the latest: UK And Japan’s Recession: Why Major Economies Are Facing Economic Downturn?

Market Sentiments

Investors closely monitor GDP revisions and forecasts, as they reflect economic health and growth prospects. While the US GDP growth remains steady, Indian GDP expectations signal a potential slowdown. These factors contribute to shifts in market sentiments and currency valuations.

Key Data Releases

Apart from GDP figures, attention is also on the US Core Personal Consumption Expenditures Index (Core PCE) and other economic indicators. Similarly, Indian GDP data and its impact on the USD/INR pair are of interest to investors, shaping trading strategies and risk assessments.

Also check: Rupee against dollar analysis

Conclusion

Updates on US and Indian GDP figures play a crucial role in shaping market sentiments and influencing the USD/INR exchange rate. As investors navigate through economic data releases and technical analyses, they seek to capitalize on opportunities while managing risks in currency trading.

Also Read Our Latest Blog: 5 Essential Financial Ratios Every Indian Stock Investor Should Understand

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.