- USD/CAD is still down for the week, but it’s moving in the right direction.

- On Friday, lower US yields and a fear of taking risks made the US Dollar go up and down.

- Tuesday’s Canada CPI and Wednesday’s FOMC meeting are important events for next week (Wednesday).

The USD/CAD hit a new daily high of 1.3772 on Friday, as the Loonie went down and the Greenback went up and down. The pair is about to lose a small amount for the week, even though it has moved away from the bottom.

Bad and ugly things

The Canadian Industrial Product Price Index went down by 0.8%, which was a surprise because the market was expecting it to go up by 1.6%. The Raw Material Price Index fell by 0.4%, which was more than the expected drop of 0%. The economic data didn’t help the Loonie, which is one of the currencies that did the worst on Friday.

The Consumer Price Index (CPI) for February will be the most important economic report for Canada next week. It will come out on Tuesday. It is expected to go up by 0.4% month over month and slow from 5.9% in January to 5.5% annually.

Friday is a mixed day for the US Dollar. It is trying to get better while stocks on Wall Street keep falling. On average, US yields are down 4%, and the 10-year yield is at 3.41%, which is just above the lows from March.

The turmoil in the banking system is still making the markets nervous, and the FOMC meeting is next week. Most people still think there will be a 25bps rate hike, but the end of the tightening cycle is seen as coming sooner than before. The change in what people thought would happen hurt the Greenback.

More lows and fewer highs.

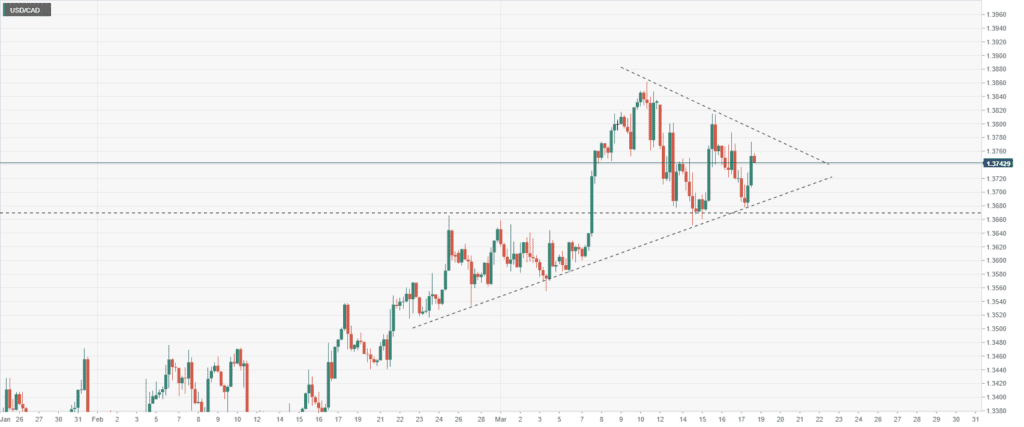

In the last few sessions, the USD/CAD has been making higher lows and lower highs. It turned around from a two-day low at 1.3676 and went up to 1.3763 on Friday. There is no clear direction in the short term.

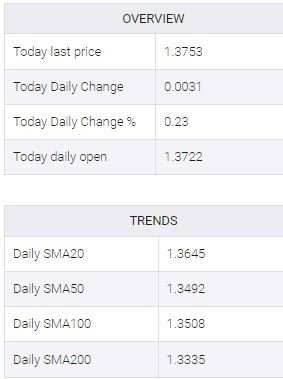

The pair is still above the 20-day simple moving average, which is 1.3655, and also above the key support area between 1.3660 and 1.3700. As long as the USD/CAD stays above those two supports, things look good for it.

USD/CAD 4-hour chart

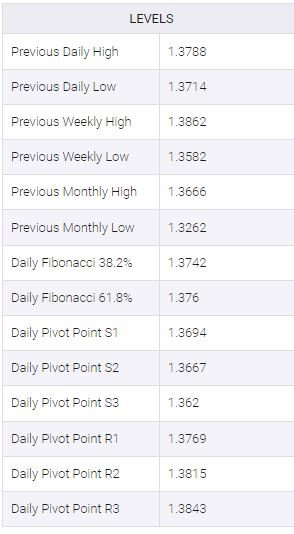

Technical levels

USD/CAD

Source: Team CurrencyVeda