February 7, 2023

New Delhi, India

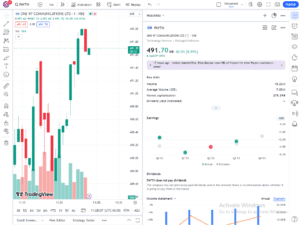

Paytm Shares Soar 13% Amid Regulatory Talks

In a recent surge, Paytm shares experienced a 10% jump in a single trading session, extending a two-day rally to a significant 13%. This surge comes amidst reports of CEO Vijay Shekhar Sharma’s meetings with top officials, including Finance Minister Nirmala Sitharaman and Reserve Bank of India (RBI) representatives, in response to regulatory restrictions on Paytm Payments Bank.

Positive Momentum from Regulatory Talks

The meetings between Paytm’s CEO and high-ranking officials have sparked optimism among investors, indicating efforts to address concerns surrounding the regulatory scrutiny faced by Paytm Payments Bank. Media reports suggest a proactive approach from Paytm in addressing the issues highlighted by regulatory authorities, which has contributed to the positive momentum in the stock market.

Analyst Recommendations Support Upside Potential

Analyst recommendations from firms such as Bernstein, which maintained an ‘Outperform’ rating on Paytm shares with a target price of Rs 600 per share, have further buoyed investor sentiment. Bernstein’s assessment that the stock was trading at attractive valuations despite regulatory challenges suggests confidence in Paytm’s ability to navigate the current landscape successfully.

Potential Regulatory Probe Raises Concerns

However, amidst the positive developments, concerns loom over potential regulatory probes. Reports indicate that the Directorate of Enforcement (ED) may initiate a formal investigation into Paytm based on issues raised by the RBI. While Paytm has denied allegations of investigation or violations of Foreign Exchange rules, the uncertainty surrounding regulatory scrutiny remains a key concern for investors.

Key Takeaways for Investors

As Paytm shares continue to experience volatility amid regulatory challenges and ongoing investigations, investors are advised to monitor developments closely. While positive momentum from regulatory talks and analyst recommendations offers some respite, the potential impact of regulatory probes on the company’s operations cannot be overlooked. Staying informed and cautious remains imperative for investors navigating the dynamic landscape of the stock market.

At the time of wrting this Paytm Shares are trading at Rs. 491 up 9%.

Also Read Latest Analysis On Rupee Vs Dollar

Check Latest Q3 Earnings

Disclaimer:

CurrencyVeda provides this news article for informational purposes only. We do not offer investment advice or recommendations. Before making any investment decisions, please conduct thorough research, consult with financial experts, and carefully consider your financial situation, risk tolerance, and investment goals. Investing in the stock market carries risks, and it’s essential to make informed choices based on your individual circumstances. CurrencyVeda is not liable for any actions taken based on the information provided in this article.