On Wednesday, the gold price gained positive momentum and reclaimed the $1,920 level. The instability at Credit Suisse appears to have rekindled concerns about a financial crisis in Europe, driving investors to seek safety. The benchmark US Treasury 10-year bond yield is down more over 6%, which is boosting the rise in XAU/USD.

Technical Overview

According to the Technical Confluence Detector, Gold recently fell below the important $1,901-1900 support that has since transformed into resistance, which includes Fibonacci levels of 161.8% on a monthly basis and 23.6% on a daily basis.

As a result, the XAU/USD looks poised to decline further in the direction of the confluence of the Pivot Point’s one-day S1 and the prior daily low near $1,895.

After that, the Pivot Point one-week R1 can serve as the final line of defence for the Gold purchasers close to $1,890.

The middle band of the Bollinger Band on Hourly Play and the Fibonacci 38.2% on One-Day both explore further higher at $1,905, so a clear upside break of that level does not necessarily signal an open invitation to Gold buyers.

Pivot Point one-week R2 and Pivot Point one-day R1 may pose obstacles to the metal’s future gains near $1,910 and $1,914 levels, respectively, even if the XAU/USD overcomes the $1,905 barrier.

Above all, the price of gold is still negative unless it surpasses the $1,924 resistance level, which is made up of the Pivot Point one-month R1 and one-day R2.

Fundamental Overview

During the midweek lull, the price of gold (XAU/USD) accepts offers to retest intraday lows near $1,900 while maintaining short-term critical support. The recent widening of the spread between the yields on US 10-year and two-year Treasury bonds serves as a major indicator for the brilliant metal. The incapacity of international officials to persuade the market of the hazards posed by the most recent fallouts from Silicon Valley Bank (SVB) and Signature Bank may also be exerting downward pressure on the price of XAU/USD. The US Dollar was also given a floor by the recent run-up in Fed fund futures, which are currently preferring a 0.25% rate hike in March, which weighs on the price of gold.

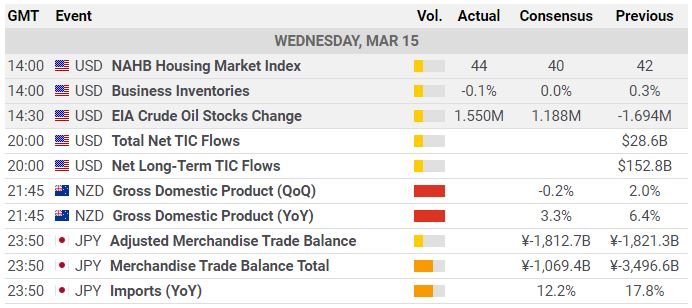

It should be highlighted that despite better odds favouring the dismal US data for Retail Sales, Industrial Output, and Producer Price Index, XAU/USD traders appear to have limited upward potential. Risk catalysts and the Federal Open Market Committee (FOMC) Monetary Policy Meeting are the two main catalysts that gold traders should pay close attention to for definitive guidance.

Source: Team CurrecyVeda