August 21, 2023

New Delhi, India

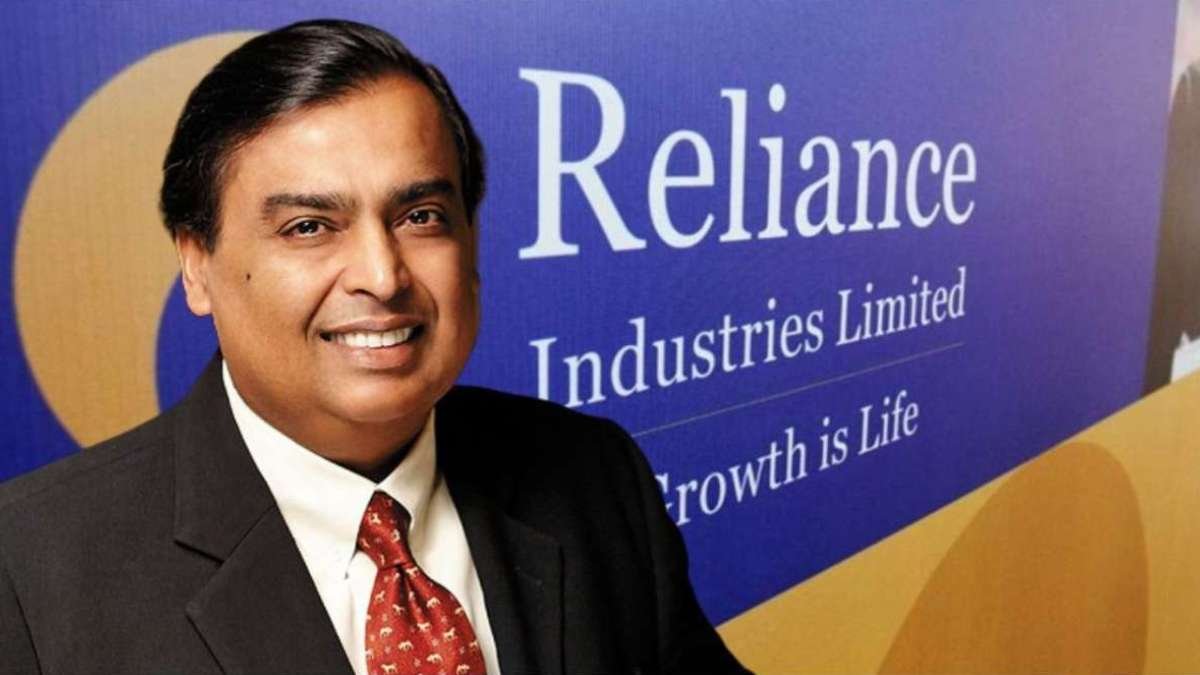

Jio Financial Services, a subsidiary of Reliance Industries, has made an impressive entry onto the stock exchanges today. The company, valued at over ₹1.66 lakh crore(20$ billion), has started trading at ₹265 on the BSE and ₹262 on the NSE, closely matching the exchange-derived price of ₹261.85 set during its demerger process.

Jio Financial Services primarily focuses on the non-banking financial company (NBFC) and credit market segments. It also has ambitious plans to expand into insurance, digital payments, and asset management, indicating its diversification strategy within the financial sector.

This move propels Jio Financial Services to the position of the second-largest listed NBFC in India, surpassing prominent names like Britannia, Hero MotoCorp, and Grasim Industries in terms of valuation. Notably, it also outpaces notable insurers like IndusInd Bank, SBI Life, and HDFC Life.

Although the stock will be under a trade-to-trade segment for the first ten sessions, its inclusion in the FTSE Russell indices and its forthcoming addition to the MSCI Global Standard Index suggests a promising trajectory on the global financial stage.

This listing underlines Reliance Industries’ strategic value unlocking for shareholders. Jio Financial Services’ debut on the stock market today, and coupling with its expansion plans, paving the way for an eventful journey in the financial landscape of India.

Tags: Jio Financial Services, Reliance Industries, Stock Exchanges, NBFC, Financial Markets, Valuation, Financial News, Global Indices, Value Unlocking. pre-market updates, CurrencyVeda, stock market, stock market listing.

Disclaimer

CurrencyVeda provides information purely for educational purposes. We are not financial advisors or brokers. The content we provide should not be taken as financial advice or a recommendation to buy or sell any sort of investment or security. Always perform your own due diligence and consult with a licensed professional before making any investment decision.