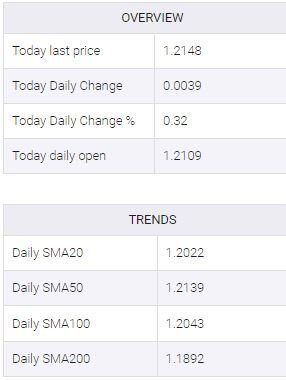

- At around 1.2150, GBP/USD trades in a positive direction.

- After the UoM Consumer Sentiment Survey, the US Dollar stays in last place.

- The pair is still on track to make gains for the week.

During European trading hours, GBP/USD fell to around 1.2100, but it picked up speed again as the US Dollar (USD) continued to lose value. During the American session, the pair seems to have stabilised at around 1.2150 and is still on track to end the week in the black.

Plunging US yields weigh on USD

Even though risk sentiment has changed for the worse, the USD is having trouble finding buyers before the weekend. The benchmark 10-year US Treasury bond yield is down nearly 5% on the day to around 3.4%. This makes the US Dollar Index (DXY) stay in the red near 104.00.

Friday, data from the University of Michigan (UoM) showed that the Consumer Confidence Index dropped from 67 in February to 63.4 at the beginning of March. More importantly, “year-ahead inflation expectations fell from 4.1% in February to 3.8%, the lowest level since April 2021,” said Joanne Hsu, director of UoM Surveys of Consumers.

Before the Fed’s important policy meeting next week, this report seems to be making investors rethink their positions. The CME Group FedWatch Tool says that there is a 68% chance that the Fed will raise rates by 25 basis points next week. This is down from almost 80% earlier in the day.

Technical levels to watch for

GBP/USD

Source: Team CurrencyVeda