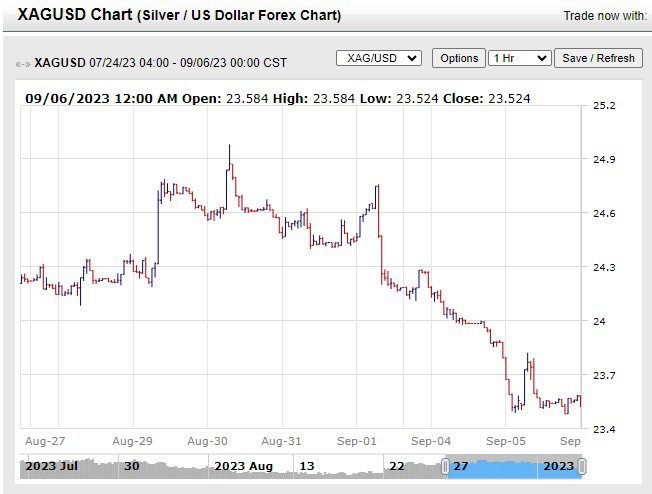

In a recent development in the precious metals market, silver prices have exhibited signs of a potential rebound following a period of decline. The market has been closely monitoring silver’s performance, with technical indicators and key price levels coming into focus.

After reaching a two-week low and experiencing its most significant daily loss in a month, silver prices have shown resilience. The oversold condition, as indicated by the Relative Strength Index (RSI), has raised the hopes of risk-taking traders. This oversold status often precedes a potential upward correction in prices.

However, the market remains cautious due to bearish signals from the Moving Average Convergence Divergence (MACD) indicator. Additionally, there is anticipation surrounding a Bull Cross formation between the 100-Simple Moving Average (SMA) and the 200-SMA. This bullish signal occurs when the short-term SMA crosses above the long-term SMA, but its confirmation is currently challenging silver sellers.

The critical price level to watch is $23.75, as surpassing this level would confirm the Bull Cross. If this milestone is achieved, silver could see a rally towards the 61.8% Fibonacci retracement level of the July to August downturn, approximately at $24.15. Further upward potential exists at the 50-SMA level of $24.25. However, a formidable downward-sloping resistance line originating from July 20, around $24.65, may present a significant obstacle for silver buyers.

Conversely, if bearish momentum persists, silver may find support at the 38.2% and 23.6% Fibonacci retracement levels, situated near $23.40 and $22.95, respectively. A breach of these support levels could potentially lead to a test of the previous monthly low, approximately at $22.25.

A four-hour chart analysis reinforces the notion of a potential further downside trend for silver, aligning with the technical sentiments outlined above.

Source: forex.tradingcharts.com

Investors and traders are advised to closely monitor developments around the $23.75 price level, as it holds the key to silver’s short-term trajectory. The precious metal’s ability to surpass this level may provide valuable insights into its future price movements in the global markets.