- Near the 0.9230 area, some people buy USD/CHF when it falls, which cuts into its intraday losses.

- Even though the USD is going up a little bit, fears of trouble in the banking sector help the pair.

- The fear of taking risks could keep the safe-haven CHF strong and limit any big gains.

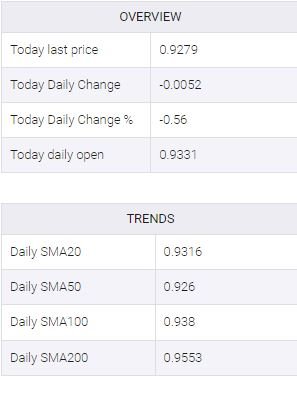

The USD/CHF pair is still down about 0.45% for the day, but it has gained more than 50 pips since its daily low. It is now trading just below the 0.9300 mark in the early North American session.

After Credit Suisse said it will use an option to borrow up to $54 billion from the Swiss National Bank (SNB) to increase liquidity, the Swiss Franc initially went up, which caused the USD/CHF pair to lose some of its big gains from the day before. The markets are still trying to figure out if the fears of a systemic crisis have been calmed, so the early optimism doesn’t last long.

Aside from this, a small recovery of the US Dollar from its daily low, helped by mostly positive macroeconomic data from the US, helps the USD/CHF pair attract some buying near 0.9230 and 0.9225. The number of people filing for unemployment fell from 212K the week before to 192K during the week ending March 10. In addition, the data from the US housing market beat what the market thought it would be.

This helps to a larger extent make up for the disappointing news about the Philly Fed Manufacturing Index, which came in at -23.2 for the current month instead of the expected -14.5, down from -24.3 the month before. This, along with the fact that most people think the Federal Reserve will raise rates by at least 25 bps next week, is good for the Greenback and helps the USD/CHF pair.

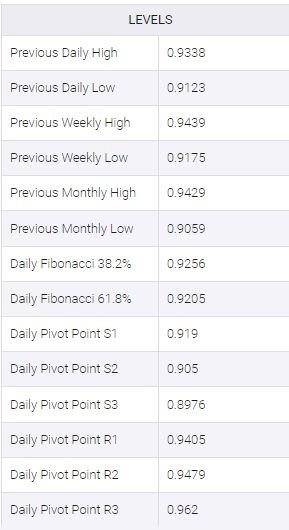

Still, the current risk-off environment, which is shown by an extended drop in the stock market, could support the safe-haven CHF and keep the USD/CHF pair from going up significantly, at least for now. So, it will be smart to wait for strong follow-through buying before positioning for a continuation of this week’s strong rebound from the lowest level since early January.

Technical levels to watch

USD/CHF

Source: Team CurrencyVeda